Sarawak Report has obtained exclusive access to a copy of the controversial 1MDB Joint Venture Agreement, completed on 28th September 2009 between Malaysia’s so-called development fund, 1MDB (One Malaysia Development Berhad) and the company PetroSaudi.

The 26 page document, which has till now been kept secret, was signed by 1MDB’s then Managing Director, Shahrol Halmi and PetroSaudi Managing Director, Tarek Obaid.

Despite 1MDB’s servers having been wiped before Christmas the copy was passed to Sarawak Report by a concerned insider just days after opposition leader Anwar Ibrahim was controversially jailed last week.

It at last enables concerned parties to scrutinise the true nature of this widely criticised deal, which was driven through by the Malaysian Prime Minister in his capacity as Minister of Finance and Chairman of the Board of Advisors to 1MDB.

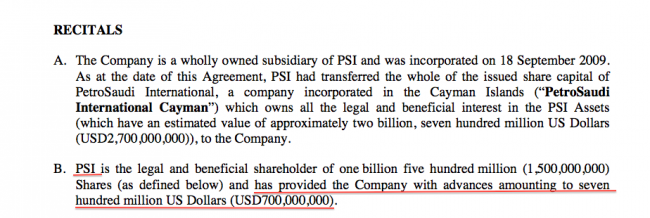

What the document reveals is that the Prime Minister and his advisors at 1MDB (believed to include the playboy tycoon Jho Low) paid USD$1billion of borrowed public money into a venture that already carried a $700,000,000 debt in the form of a loan from PetroSaudi’s parent company to the subsidiary that was entering into the joint venture, PetroSaudi Holdings (Caymans) Limited.

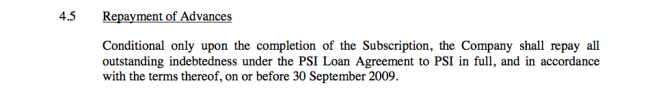

Crucially, under the terms of the joint venture, agreed to by 1MDB, the Malaysian development fund had committed to pay back this whopping great loan to the parent company, PetroSaudi International, on day one of the joint venture!

Nothing more than a $700,000,000 scam?

Sarawak Report is now publishing the entire joint venture document, which has been kept secret till now, in full.

We do so in defiance of the obsessive secrecy of the Malaysian Government, which ought to have made such documents transparent and available in its public accounts.

Last week we revealed that the fund has wiped all its computer records in a further apparent attempt to conceal its investment activities.

Drawn up in great legal detail by the UK based office of the international law firm White & Case, the key requirement for 1MDB to pay back the PetroSaudi loan is couched in subtle legal language.

However, careful scrutiny of the document makes it perfectly plain that these are the terms of the agreement, which Najib Razak entered into on behalf of 1MDB:

Opposition spokesman Tony Pua has campaigned for Malaysia’s Public Accounts Committee to be allowed full scrutiny of 1MDB’s affairs, which have proved a growing fiasco with current debts of over RM40billion.

He told Sarawak Report that any legal scrutiny of the Joint Venture document would have identified the debt burden and the requirement upon 1MDB to repay it:

“It is like you or me buying a house that has a great big loan of two thirds of its market value outstanding on the property. Who in their right mind would buy into such a deal?”, said Pua.

The up front debt payment to PetroSaudi’s parent company means that only $300,000,000 of the original $1billion paid into the venture by 1MDB would have been left available for activities by the fund.

The joint venture document also makes provision for a whopping further $5billion in future funding by 1MDB into the dodgy venture on “terms to be agreed”:

- Further Funding

- (a) The Shareholders intend to make further contributions to the Company in the form of cash and assets of up to a total amount of fivebillion USDollars (USD5,000,000,000) at a level and on terms to be agreed by 1MDB and PSI in their respective Shareholding Proportions.

False claims boosted the image of private company PetroSaudi

Sarawak Report has already noted that the original claims by Najib and 1MDB, which implied that PetroSaudi was paying a further $1.5billion into the Joint Venture, were false:

The little known oil company (which was based out of a shared office in Geneva at the time) had in fact paid zero cash into the deal, having apparently invested its so-called assets into the venture instead.

These assets consisted mainly of a proclaimed oil concession in the Caspian Sea, which was supposed to be worth over $2.5billion.

But, again, the suspicious secrecy surrounding the entire joint venture deal has made such claims impossible to prove.

No cash injection, only cash extraction

And, while Najib and the 1MDB press releases had falsely implied that there had been a cash injection from PetroSaudi, no mention has ever been publicly made till now of this cash extraction instead, of $700,000,000 on day one of the deal.

Another falsehood promoted by Najib and 1MDB’s publicity machine at the time of the joint venture on 29th September 2009 was the suggestion that PetroSaudi was somehow officially connected to the State of Saudi Arabia.

Observers, including Sarawak Report, later proved that the company was in fact a private venture set up by a little-known Saudi businessman called Tarek Obaid and his pal, who happened to be one of the many princes of Saudi Arabia.

Prince Turki bin Abdullah has recently been relieved from his post as Governor of Riyadh, a position he only achieved after the PetroSaudi deal.

Since PM Najib Razak seems to have achieved such a shockingly poor deal for the Malaysian development fund in this its very first joint venture, many will be asking if it is time for him also to be relieved of his post?