Sarawak Report awaits 1MDB Arul Kanda’s suit for libel over our allegedly ‘unsubstantiated’ reports.

In his latest press release he claims that our PetroSaudi evidence is ‘unfounded’ and ‘possibly doctored’, while admitting that our copies of 1MDB Board minutes were accurate.

If any of the documents which we have produced about the joint venture deal between 1MDB and PetroSaudi are “possibly doctored” as he ventures to suggest, it would, of course, be the easiest thing in the world for Mr Kanda to produce the evidence from his own records and explain the truth to a UK court.

Likewise, if our allegations were “unfounded”, why has the only remaining institution in Malaysia that retains a shred of credibility in the eyes of the world, Bank Negara Malaysia, backed our findings down to the very last dollar?

We have detailed how US$1 billion US$500 million US$330 million (= US$1.83 billion) were channelled from 1MDB into a fraudulent deal with PetroSaudi, where most of the money was diverted into the Zurich account of the company Good Star Limited belonging to its official ‘Advisor’ Jho Low.

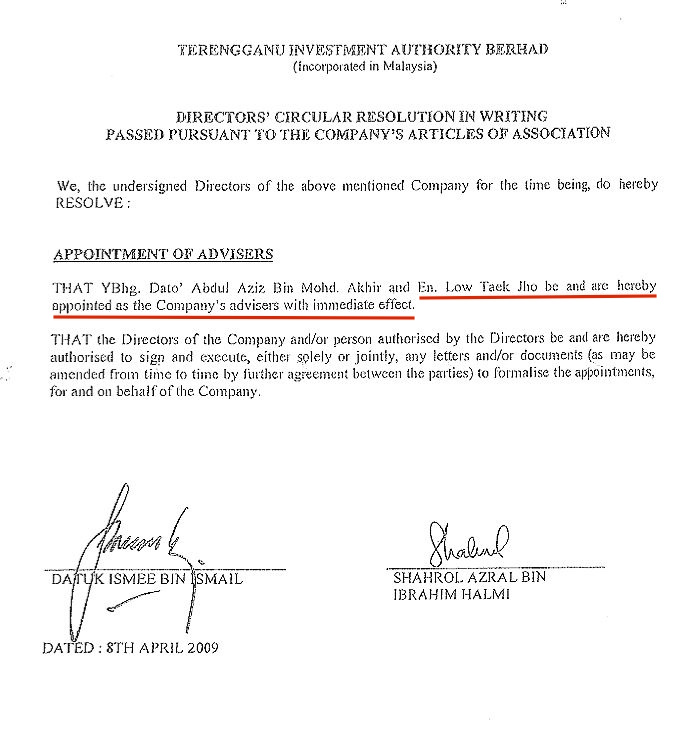

See for the first time the document (which Mr Kanda is welcome to dispute) that proves the official nature of Jho Low’s role at the Terengganu/ 1MDB Development Fund, which he has so emphatically denied for so long:

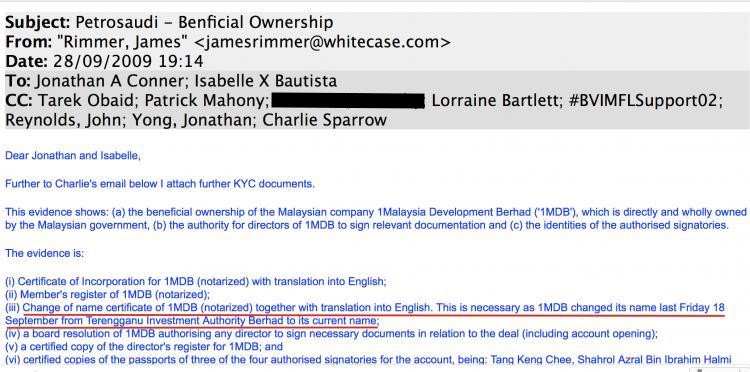

The Terengganu Investment Authority changed its name to 1MDB half way through the Petro-Saudi deal on September 18th 2009, which Jho Low managed from beginning to end, despite his repeated claims that he had nothing to do with 1MDB after May 2009.

PetroSaudi’s lawyer from White & Case noted the date in an email (which Mr Kanda is welcome to dispute)

Last week, of course, Bank Negara confirmed our findings on the purloined US$1.83 billion by demanding this exact sum of money back and baldly stating that it had recommended criminal proceedings against 1MDB for allowing the PetroSaudi scam to proceed:

“The Bank concluded that permissions required under the ECA [Exchange Control Act] for 1MDB’s investments abroad were obtained based on inaccurate or without complete disclosure of material information relevant to the Bank’s assessment of 1MDB’s applications.

Therefore, the Bank has revoked three permissions granted to 1MDB under the ECA for investments abroad totalling USD1.83 billion and also issued a direction under the Financial Services Act 2013 to 1MDB to repatriate the amount of USD1.83 billion to Malaysia and submit a plan to the Bank for this purpose”.[Bank Negara Statement]

Despite this plain speaking by Bank Negara, Arul Kanda still attempts to say that our allegations are “unfounded” and that our evidence is “possibly doctored” – whilst not suing us.

He also refers to one our several sources as a “convicted criminal”, whilst conveniently neglecting to mention that this Swiss national, Xavier Justo, was a former senior director of 1MDB’s own joint venture partner PetroSaudi and that he was convicted (in Thailand) for attempting to blackmail his fellow PetroSaudi directors, using evidence about their role in the 1MDB billion dollar scam.

Mr Arul Kanda is welcome to sue Sarawak Report on the basis that Justo was convicted of blackmail, using a trove of fictitious evidence.

Meanwhile, the opposition MP Tony Pua has concluded that Kanda, through his string of conflicting statements and changing stories, has proved himself to be a serial, if highly unconvincing, liar.

How 1MDB Cheated Bank Negara

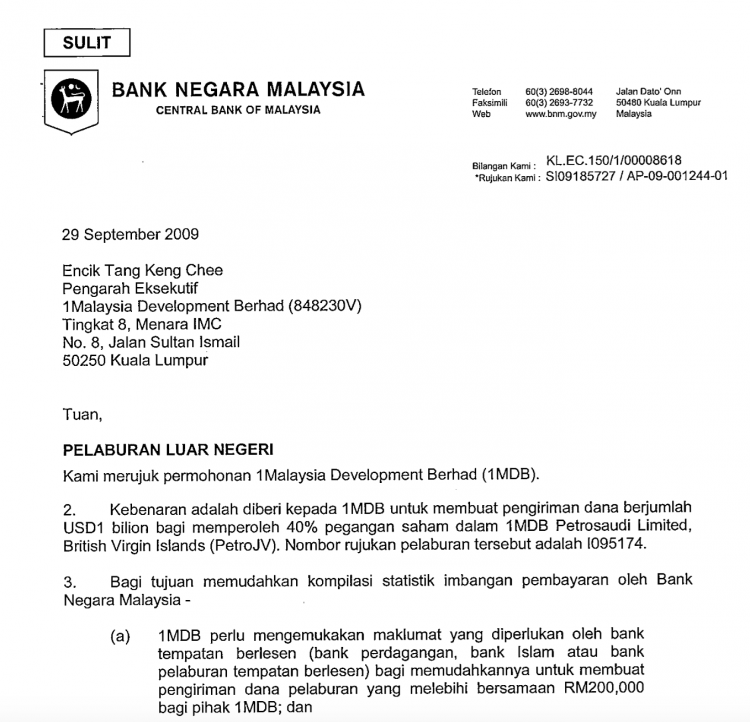

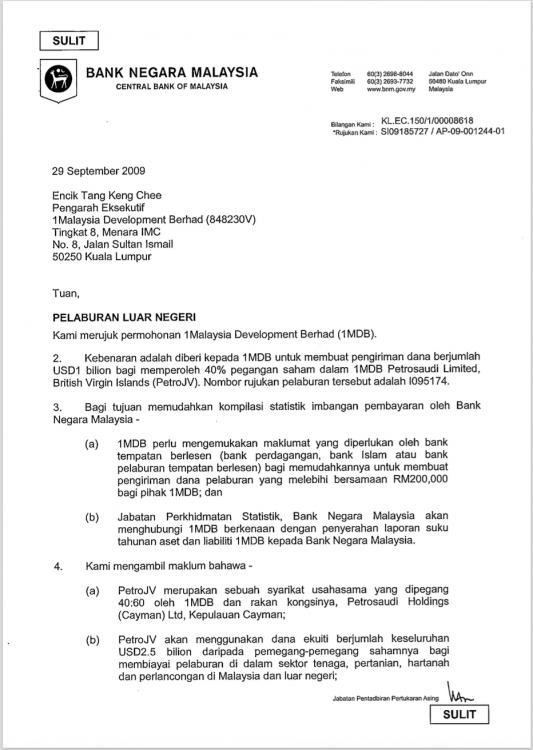

Through PetroSaudi’s own emails Sarawak Report has obtained the Letter of Permission from Bank Negara to 1MDB’s initial request to export a billion dollars into the alleged joint venture in September 2009.

PetroSaudi, 1MDB and Bank Negara are welcome to contest the authenticity of this and other documents, which we are now releasing.

Meanwhile, we suggest that this letter shows exactly why the bank is now saying that it was seriously and deliberately mislead by 1MDB and why it is demanding the money back and wants to issue criminal proceedings.

The letter was originally written in Malay, then PetroSaudi received a certified English translation.

If our reproduction here has been “tampered” or “doctored” in any way, then of course anyone from the Bank Negara, 1MDB or PetroSaudi itself will be very well-placed to sue Sarawak Report for misrepresentation and publish the correct version in the meantime:

[Click For the full Malay and English versions of the BNM letter – also see the base of this story].

This letter of authorisation, which was sent by the Director of the Foreign Exchange Administration Department to 1MDB’s then Executive Director, Mr Tang Keng Chee, grants permission for the payment of the initial US$1 billion on the basis that amongst other provisions:

“PetroJV will utilize the equity funds totaling USD 2.5 billion from its shareholders to fund the investment in the energy, agriculture, real estate and tourism sectors in Malaysia and overseas;

The said funds in the sum of USD 2.5 billion will be placed in PetroJV’s account with Banca della Svizzera Italiana SA, Geneva pending investments in future projects;

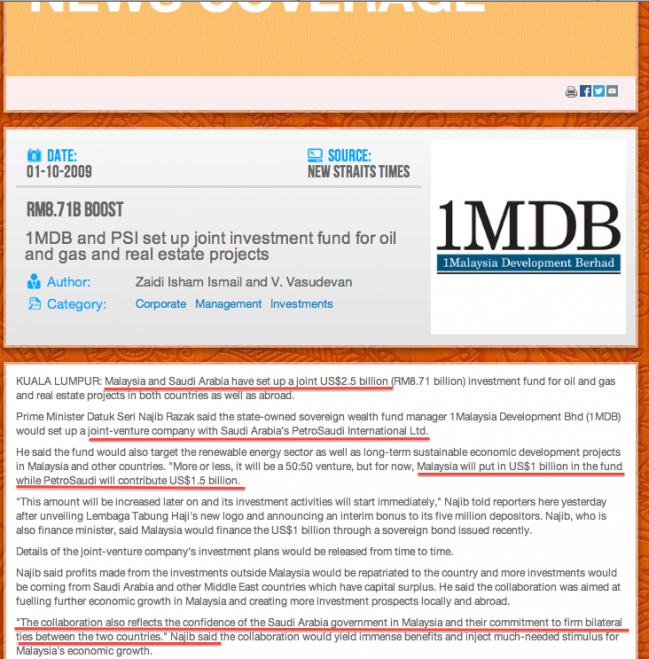

In other words, the letter makes plain that BMN was of the clear understanding that 1MDB was providing 40% of a cash injection into a joint fund, which would be combined with a US$1.5 billion cash investment by PetroSaudi, designed to fund a variety of projects, including investments in Malaysia.

That understanding was reflected 1MDB’s own press releases of the time (since noticeably removed from its site):

As is now known, PetroSaudi in the event contributed no cash to the deal and the majority of the billion dollars injected by 1MDB was not paid into the joint venture account, but into Jho Low’s own company Good Star’s account at RBS Coutts in Zurich. Bank Negara Malaysia was therefore misled, just like the public.

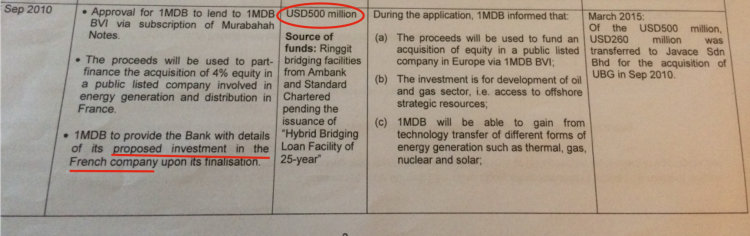

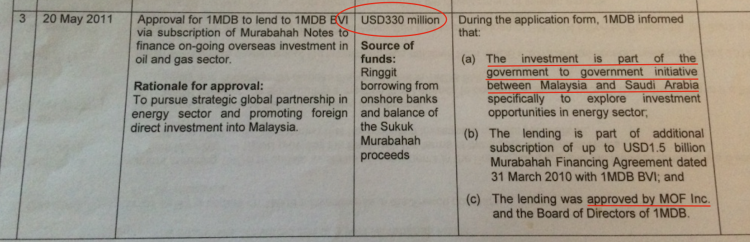

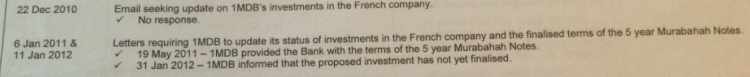

Investigation documents produced by Bank Negara (below) show that repeated later queries about how the money was being invested were ignored and put off by 1MDB, which instead went on to borrow a further US$500 million and US$330 million on similar false pretences, which likewise disappeared mainly into Jho Low’s account at Good Star or into the buy out of UBG (in which he held shares).

Bank Negara’s investigation shows when it tried to follow up on the payments they were given the brush-off by 1MDB or faced extraordinary delays and partial responses.

It is plainly for this reason that BMN wants all the 1MDB PetroSaudi money returned and has requested for criminal proceedings to be opened. Indeed the previous Attorney General Gani Patail had started drawing up charge sheets for prosecutions related to 1MDB.

However, as Malaysia knows, Najib responded with an executive coup – he replaced the Head of Special Branch, who then sent a team of officers to apprehend Gani Patail as he arrived at his office on Monday 27th July. Patail was informed that he was to retire immediately on ‘health grounds’ without entering his office to collect his things.

It is unconstitutional for the Prime Minister to fire an Attorney General and it is unconstitutional for him to personally hand-pick a successor.

However, this is exactly what Najib has done and new his hand-picked AG, Apandi Ali, is now refusing to act upon Bank Negara’s recommendation to prosecute 1MDB.

So, when Arul Kanda continues to issue sanctimonious press releases saying all is well with 1MDB and that Sarawak Report is ‘doctoring’ documents. Is he relying on the facts or just the strong arm tactics of his boss?

Fraudulent valuation of PetroSaudi

A key element of the criminal case against 1MDB is the astonishing and wilfully negligent failure of the board and directors of this public company to obtain an independent valuation of its proposed joint venture partner PetroSaudi, introduced by the PM’s appointed ‘advisor’ Jho Low.

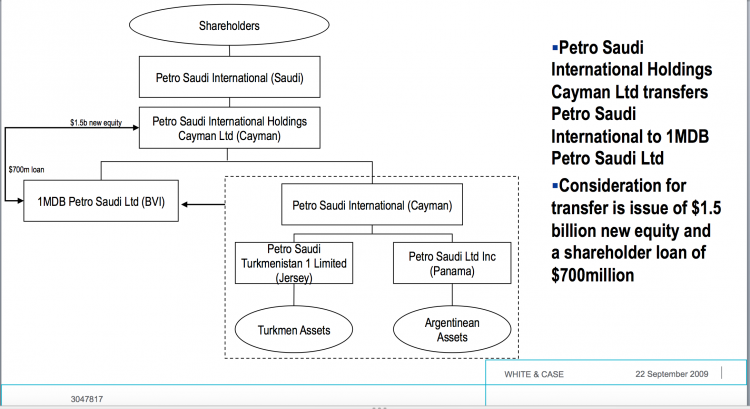

Instead of placing cash as advertised to BNM and the public into the so-called joint venture, it emerged during the course of the two week lightening negotiation period that PetroSaudi was merely injecting ‘assets’ in the form of a subsidiary company (PetroSaudi International (Cayman) that allegedly owned valuable oil concessions in Turkmenistan and Argentina.

However, PetroSaudi did not own the Turkmenistan oil field, it belonged to a Canadian company called Buried Hill instead. Furthermore, the concession was valueless to the extent that it is located in a disputed region of the Caspian Sea, making it currently impossible to legalise the ownership or extract the oil.

That didn’t stop PetroSaudi claiming the ownership and issuing a fictitious $700 million ‘shareholder loan’ as part of the supposed asset transfer to the joint venture company, which three days later it would demand back in hard cash!

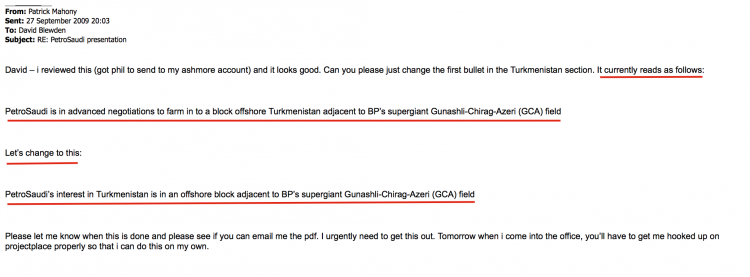

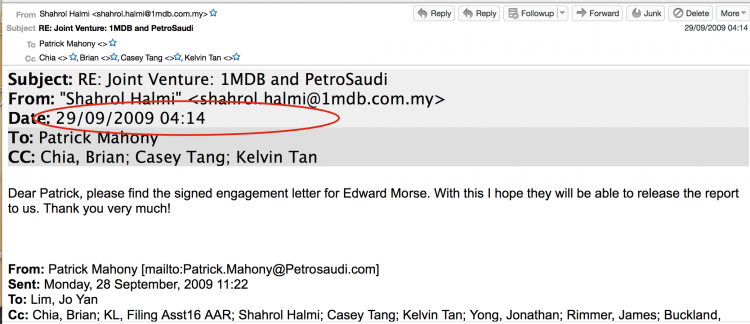

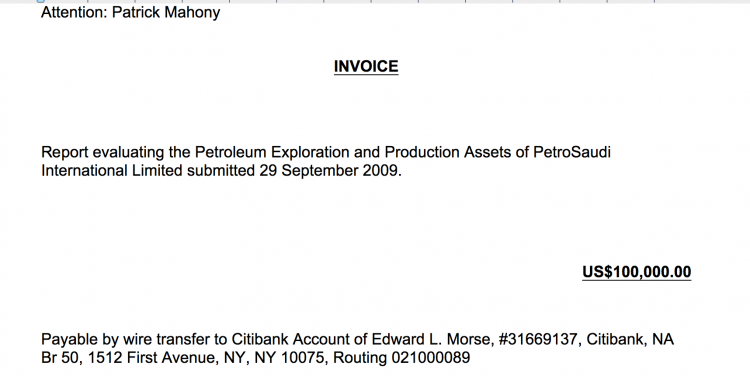

To supposedly cover its obligations during the checking period on the lightening deal the 1MDB Board, directed by Shahrol Halmi, agreed to accept a valuation of this PetroSaudi International (Cayman) subsidiary from an American, who was recommended by none other than PetroSaudi Director Patrick Mahony himself, a banker called Ed Morse.

Morse was a prominent former politician and is currently Commodities Head of Citigroup, but in 2009 he was out of work, having lost his job with the closure of Lehman Brothers. He was also a close contact of Patrick Mahony and Tarek Obaid and the men were in regular touch before and after the 1MDB deal.

It was Mahony who hired Morse to value his own company PetroSaudi International (Cayman) – he then passed this document on to Shahrol Halmi as if it were an independent third party valuation!

The fact that this was only a window dressing exercise to please the auditors is further made clear by the fact that the Malaysian end of this dodgy deal only received Ed Morse’s tame document the day AFTER the deal had already been signed on 29th September 2009.

Further correspondence shows that Morse derived all of his information for his “independent report” from a document sent to him by Mahony himself just a couple of days before he wrote it up.

He admits as much in his own report:

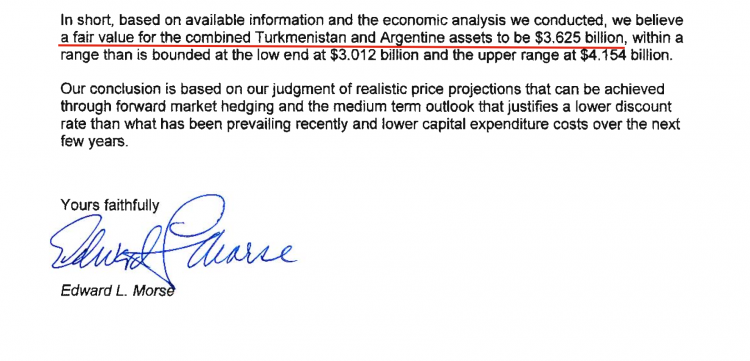

“The analyses, opinions and conclusions presented in this report are based on our best economic judgments on the data that were made available to us by the managements of PetroSaudi International Limited and 1MDB PetroSaudi Limited” [Ed Morse report]

If Morse had checked out any of the data provided by PetroSaudi, he would have realised that they did not own the Turkmenistan oil field and that an Argentine concession was mainly funded with borrowed funds. Instead he summarised:

Morse was offered US$50,000 for this re-jigged version of PetroSaudi’s own figures, which was in the event bumped up to double by Patrick Mahony – presumably as a thanks for getting such a massive evaluation job done in just a couple of days!

Laughably, the 1MDB Board and management were prepared to accept this so-called ‘injection of assets’ purely in the form of the transfer of ownership of PetroSaudi’s subsidiary company in the Caymans.

There was no legal transfer of any of that company’s supposed assets, for example the alleged Turkmenistan oil concession – meaning that the joint venture was left with little more than a shell company with nothing in it, in return for its own billion dollar investment. Plus a demand for a fictitious $700 million loan repayment!

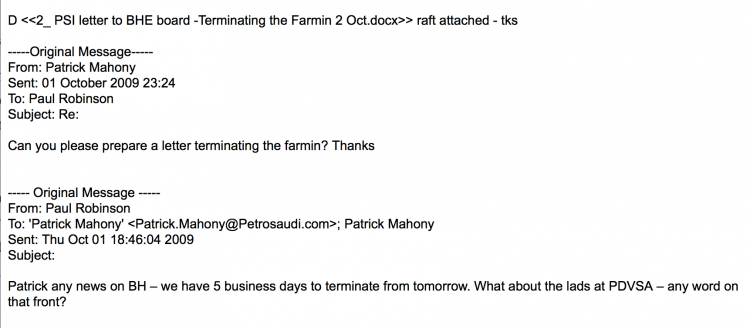

A couple of days after the deal was signed Patrick Mahony cynically gave orders to his team to wind down the ‘advanced negotiations’ for a so-called farmin agreement with Buried Hill for the Turkmenistan oil field. He wanted to get out before PetroSaudi was committed, one reason doubtless for the haste of the joint venture negotiations!

Fraudulent transfer

As if such blatant and wilful negligence by the Board and management of a public company in dealing with PetroSaudi’s blatant shenanigans were not enough to prompt Bank Negara’s criminal case against 1MDB, the matter of course gets worse.

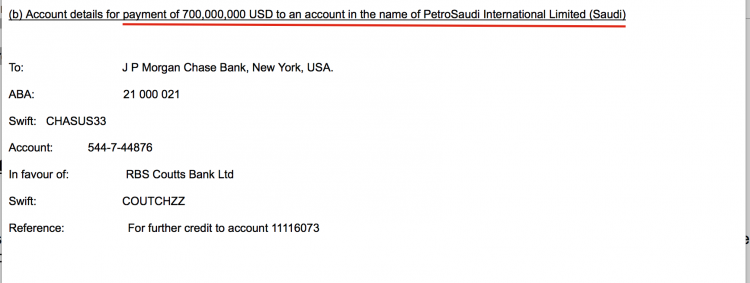

Bank Negara was specifically informed that all the US$1 billion being paid into the PetroSaudi venture was going to the joint venture company itself.

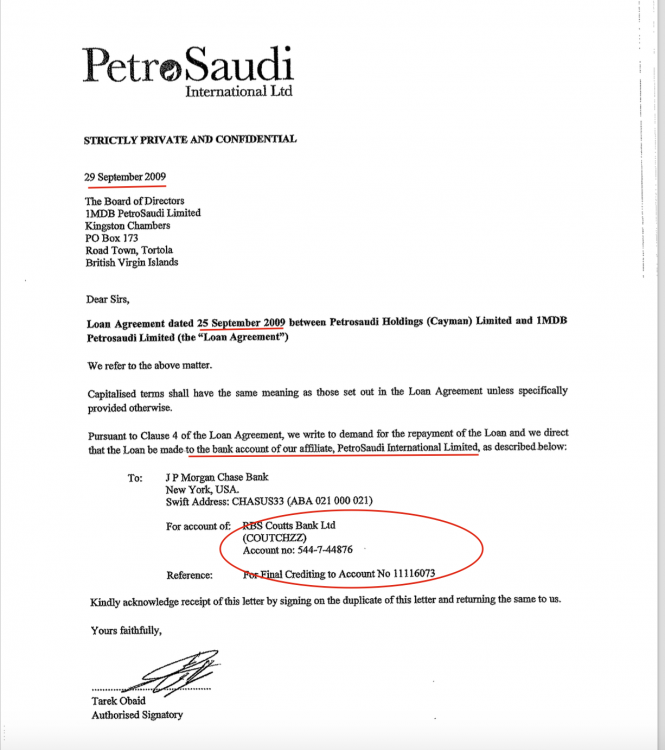

Instead, of course, the conspirators behind the deal had injected a fictitious US$700 million ‘shareholder’ paper ‘loan’ into the equation on the 25th of September, just 3 days before the signing of the deal.

It turns out that this was not communicated to the Board by the management of 1MDB led by then and current Board Member CEO Shahrol Halmi.

Having issued this paper loan to their subsidiary on 25th Seotember, PetroSaudi and their lawyers then requested the money be paid directly back to PetroSaudi by 1MDB in cold hard cash on the day of the deal, 29th September.

This ‘repayment’ was dressed up as a consideration for the huge extra value of the supposed assets of the injected Cayman subsidiary, which Morse had put at US$3 billion, but were actually fictitious, unchecked and legally unsecured.

It gets worse, because of course as we all know the US$700 million did not even get ‘paid back’ to PetroSauidi, it got paid directly to a company owned by Jho Low called Good Star Limited, incorporated in the Seychelles.

There is a mound of evidence to show that PetroSaudi, in particular Patrick Mahony, deliberately lied to 1MDB on this point, claiming that Good Star was a PetroSaudi subsidiary.

The conspirators have continued to make this claim and lie in recent weeks in various statements seeking to imply that the money went to PetroSaudi instead of Jho Low:

“In a statement to The New York Times this week, 1MDB said that Good Star was owned by PetroSaudi and noted that PetroSaudi had confirmed that 1MDB said it had provided information about these transactions to the Malaysian authorities that are investigating the sovereign fund.”[NYT 18/6/15]

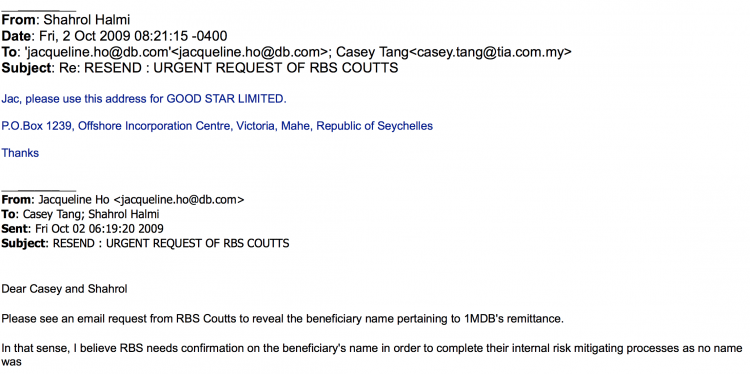

Shahrol Halmi also knew full well that the money was being ‘paid back’ not to PetroSaudi but to Good Star, as his emails make plain. If he had checked the beneficial ownership of Good Star he would have realised it belonged to Jho Low and that the company was not part of the ownership structure of PetroSaudi.

Likewise, if RBS Coutts had done its proper due diligence and checked the incorporation documents of Good Star, it would have realised the same fact.

As Tony Pua has pointed out in his statement on the matter this weekend, there is only one explanation for the failure of the Board and Management to conduct due diligence over the decisions of 1MDB, which is that the fund’s special terms of incorporation meant that there is in fact only one decision-maker authorised to make investments – this is the sole shareholder, the PM/ Minister of Finance Najib Razak, who had disguised himself as the mere Chairman of the Advisory Board.

In fact the constitution of 1MDB means that the role of the Board is mere window dressing, hence their side-lining from the PetroSaudi deal and other future expenditures that succeeded in running up a staggering RM42 billion of debt in less than five years:

“According to Clause 117 of the 1MDB Memorandum and Articles of Association (M&A), the Prime Minister’s written approval must be obtained for “any financial commitment (including investment), restructuring or any other matter … It is clear their [the Board] appointment was only for show. They are mere stooges working for the powers that be. No Board worth their salt would have tolerated the degree of transgressions which took place within the company which included embezzlement and misappropriation of billions of ringgit.” [Tony Pua media statement]

Mr Arul Kanda is of course welcome to again say that the emails and documents we have published from the PetroSaudi database, which are also in the hands of international regulators and other news organisations have been ‘possibly doctored’ and ‘tampered’ by Sarawak Report.

He should take us to court and compare his copies with ours and explain why it is that all the surrounding evidence about the 1MDB PetroSaudi affair ties in nicely with our allegations, while for his part he cannot stick to the same answer two days running.

Malay Version of the Bank Negara Letter of Permission:

Page 2

English translation:

Confidential

BANK NEGARA MALAYSIA

CENTRAL BANK OF MALAYSIA

29 September 2009

Mr Tang Keng Chee

Executive Director

1Malaysia Development Berhad (848230V)

Level 8, Menara IMC,

No.8, Jalan Sultan Ismail,

50250 Kuala Lumpur.

Sir,

OFF-SHORE INVESTMENT

We refer to the 1Malaysia Development Berhad application (1MDB).

- Permission is given to 1MDB to remit funds in the sum of USD1 billion for the purpose of obtaining 40% shareholding in 1MDB Petrosaudi Limited, British Virgin Islands (PetroJV). The reference number of the said investment is IO95174.

- For the purpose of simplifying the statistical compilation of the balance payments by the Central Bank of Malaysia-

(a) 1MDB has to disclose the information required by the local licensed bank (commercial bank, Islamic bank or local investment bank) for convenience in remitting the investment funds which is in excess of RM 200, 000 on behalf of 1MDB; and

(b) The Malaysian Central Bank’s Department of Statistics will contact 1MDB with regard to a quarterly report in respect of 1MDB’s assets and liabilities to be submitted to the Central Bank of Malaysia.

- We note the following-

(a) PetroJV is a joint venture company held 40:60 by 1MDB and its joint venture partner, Petrosaudi Holdings (Cayman) Ltd, Cayman Islands;

(b) PetroJV will utilize the equity funds totaling USD 2.5 billion from its shareholders to fund the investment in the energy, agriculture, real estate and tourism sectors in Malaysia and overseas;

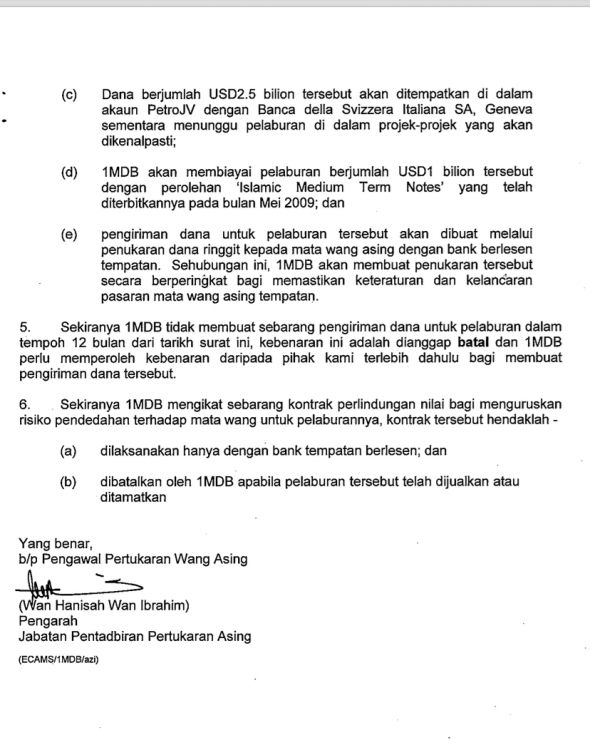

(c) The said funds in the sum of USD 2.5 billion will be placed in PetroJV’s account with Banca della Svizzera Italiana SA, Geneva pending investments in future projects;

(d) 1MDB will fund the investment in the sum of USD 1 billion with the acquisition of “Islamic Medium Term Notes” which were issued in May 2009; and

(e) The remittance of such funds for the said investment will be done via a foreign exchange of the funds in Ringgit to the relevant foreign currency with a local licensed bank. In this connection, 1MDB will make the exchanges in stages to ensure order and smoothness in the local foreign currency market.

- In the event that 1MDB does not make any remittance of funds for its investment in the period of 12 months from the date of this letter, this approval will be rendered cancelled and 1MDB would be required to obtain permission from us prior to the remittance of such funds.

- In the event that 1MDB is bound by any value protection contract to manage currency exposure risks for its investments, the contract has to be:-

(a) executed with a local licensed bank; and

(b) terminated by 1MDB when the said investment is sold or has come to

an end.

Yours faithfully,

On behalf of Foreign Exchange Officer

(Wan Hanisah Wan Ibrahim)

Director

Foreign Exchange Administration