It is exactly a year since Sarawak Report detailed the information provided by the company PetroSaudi’s database, which exposed the fraud behind the so-called 1MDB PetroSaudi joint venture, through which US$1.83 billion dollars were removed from Malaysia’s public purse.

This is now corroborated by Malaysia’s own Central Bank Negara, which recently issued a formal demand that 1MDB repatriate the cash.

Our expose was based on a number of sources, besides the database, which covers the years 2009-11 and consists of over 330,000 emails, attachments and documents, many of them relating to deals with 1MDB.

We published a several of the most significant documents at that time, which is why the major scandal over 1MDB erupted and went on to spark a number of further official investigations into this and later deals by 1MDB, which in turn threw up more damning information over ensuing months – including the US$681 million that went into the PM’s personal account in 2013.

Unlike the changing stories coming out from 1MDB and their boss the Finance Minister, the narrative unveiled by all these separate sources and investigations has been glaringly consistent.

It all points to the conclusion that the so-called development fund has been used to pillage billions of public money from the state – the Swiss Attorney General last month said to his knowledge at least $4 billion had been nicked.

So, how have the actors in this matter responded? Predictably, they have accused Sarawak Report of having stolen and then forged or ‘tampered’ with all these thousands of documents, in order to provide the coherent and corroborated narrative that so far no one has managed to disprove in any way.

A mentally ill, hired bankrupt, Lester Melanyi, was paraded by the new UMNO communications boss, the housing minister Rahman Dahlan, to say that he knew this to be the case. Lester was soon spectacularly de-bunked, however the Malaysian Government used this episode to block Sarawak Report and so it remains.

Meanwhile, the Malaysian Government, together with PetroSaudi, had placed enormous pressure on the Thai authorities to arrest the former director of PetroSaudi who had supplied the material. He is now in a Bangkok prison for supposedly trying to extort cash from poor old PetroSaudi and has now issued statements saying he thinks that Sarawak Report is ‘tampering’ with what he now alleges were in fact innocent documents he was supposedly using to extort money with.

PetroSaudi, in their coup de gras even hired a struggling UK “cyber intelligence” firm called Protection Group International to send their flagship employee out to Bangkok (a retired chap from GCHQ called Brian Lord) who went on the record to the UMNO rag New Straits Times saying that his ‘expert’ team of cyber-sleuths had identified clear signs of tampering in the documents we had placed on line.

What the so-called “meta-data” Lord was referring to revealed (just right click and check) was merely that Xavier Justo had earlier opened one of the documents we had featured. How does this amount to ‘tampering’ by Sarawak Report we asked?

Lord then went on to say in July of last year that his ‘expert teams’, employing the most advanced of cyber technologies would, under special ‘laboratory conditions’, examine the data they had retrieved from the arrested Mr Justo in order to prove how Sarawak Report had nefariously tampered with it in order, presumably, to give a false impression of wrong-doing in what his paymasters at PetroSaudi had informed him was a snow white deal.

Mr Lord explained to journalists that this process might take up to six months before his report could be produced. In the meantime he delivered a lecture to Sarawak Report on what constituted good journalism in his professional view as a cyber intelligence spook – and committed several gross libels in the process.

As it is now well over the six months cited, what has Mr Lord’s lab team come up with?

So far, nothing. Not one example of forgery, fraud or tampering has been produced as the 1MDB furore has raged explosively around the Prime Minister of Malaysia and the company of his employers PetroSaudi International.

Sarawak Report has been told by genuine cyber-experts that Protection Group International does not have a laboratory and is not considered to be technically particularly advanced in the field of data retrieval, being they are mainly ex-marines who specialise in bodyguard/surveillance activities.

However, nine months is a long time. Enough time to create a new parallel database that transforms a dodgy deal into an innocent affair? That should not be too technically tricky, although with those 330,000 emails it would take some effort.

Indeed, Sarawak Report has found itself suddenly approached by a number of news organisations who are interested in seeing our raw material… it appears that PetroSaudi has been contacting certain senior news figures to say that they can now prove our own material is fraudulent.

How interesting. Why has PetroSaudi not taken us to court, if this were the case, many months ago?

We have in fact always been willing to share this material and have done so. Most news organisations however do not have the leisure to tackle raw source material… they generally prefer stories that take a couple of hours to write.

This may have changed now that PetroSaudi appears to be throwing down the gauntlet. So SR is indeed making the material available to selected journalists and we are also now making our own 1st anniversary review of the Justo Files to lay out exactly how the deal worked out in detail.

The Justo Files – Day 1

Today, we are pulling out from the PetroSaudi database the unfolding detail of just how the company got together with Jho Low, who was plainly working with his side-kick Seet Li Lin and legal Girl Friday Tiffany Heah, for a ‘Big Boss” back in Malaysia.

These are the email trails available from August 2009 on the file, dating from just after the meeting on a hired yacht between Jho Low, Najib and the two PSI Directors, Prince Turki and Tarek Obaid, up until mid-September, when the deal started to get fully underway with the alerting of the staff at 1MDB (under CEO Shahrol Halmi) that there was an investment cooking, which they were expect to engage in.

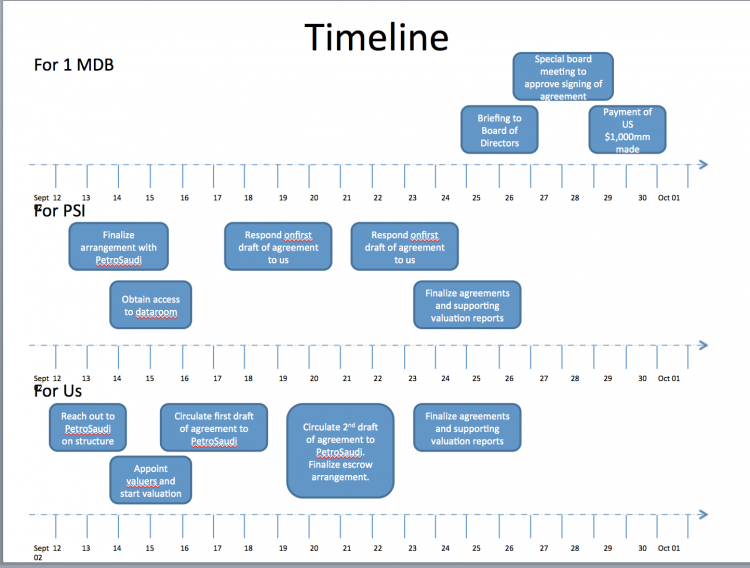

Halmi was given just two weeks, from 15th September to the end of the month to get cracking and comply his end with the US$1 billion dollar ‘investment’.

He plainly had no trouble with this, although the 1MDB Board did – one good reason why the Auditor General’s report this week into the whole farce has been classified as an Official Secret by the Prime Minister!

From the database it is easy to tease out a relatively small number of email trails between the five main actors at PetroSaudi and 1MDB, which detail in plain black and white what they were up to.

One in particular, sent excitedly by Tarek Obaid (who at the time was dealing with threats from the bank to block his Amex Card) to Patrick Mahony early in the morning on September 14th seems to sum up the nature of the proceedings:

“Dude – on doit fermer avec eux, jho ma reveiller la, et ils sont prets a verser un milliard…………. D ici la fin du mois appelle quand tu te treveille je suis a londres

This translates:

“Dude . we have to close this with them, jho just woke me up , and they are ready to transfer one billion…… before the end of the month. Call when you wake up I am in London”

Sarawak Report defies PetroSaudi’s denials that this and the rest of our material is correct and we challenge them to take us to court to test the evidence. Meanwhile, we invite readers to look in detail at the emails and documents of those first few days of the deal below:

Email trail 1 – Subject “Our Discussion”

The first set of emails relating to the PetroSaudi joint venture with 1MDB pops up on the database just days after that meeting on the hired yacht Alfa Nero in August 2009. Clearly Jho Low and Tarek Obaid had had a discussion and Tarek, who is not regarded as a great business brain by those around him, proceeded to introduce the British businessman Patrick Mahony to his contact, who is regarded as an astute deal-maker.

Mahony was a long-standing pal of Tarek’s by this time. Clearly Tarek was a good contact in the Middle East, given his friendship with the fun-loving Prince Turki, a retired Saudi pilot. He was at that time still working with the investment fund Ashmore (which had put some seed money into PetroSaudi’s only current venture, an oil well in Argentina), but had opened up an email account at PetroSaudi, to which he would soon move formally as a director, after apparently moonlighting from Ashmore over setting up this deal with 1MDB.

As this email trail shows, Tarek was introducing Patrick to Jho Low in order to move ahead with plans that had been discussed – the meeting took place in September 2009 in New York’s Time Warner Tower, where Jho Low had his mega apartment.

Sender: [email protected]

Subject: Re: Our Discussion

Message-Id: <1770832949-1252285569-cardhu_decombobulator_blackberry.rim.net-1558495444-@bda038.bisx.prod.on.blackberry>

Recipient: [email protected]

Subject:

Re: Our Discussion

From: [email protected] <[email protected]

Date: 07/09/2009 02:06

To: Jho Low (TWG); Patrick Mahony; Tiffany Heah

Dear Patrick,

The reservation will be under Jho Low. See you tmr. Regards Seet

Sent via BlackBerry from T-Mobile

_____

From: [email protected] Date: Mon, 7 Sep 2009 00:57:59 0000 To: Patrick Mahony<[email protected]>; <[email protected]> Subject: Re: Our Discussion

How abt 2pm lunch at masa japanese at time warner?

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Mon, 7 Sep 2009 02:20:55 0200 To: Taek Jho Low<[email protected]> Subject: Re: Our Discussion

Tried calling earlier. Am in nyc. You can reach me on the swiss number below or 44 7796 226 358. Let me know when you want to meet tomorrow. If we could meet around lunchtime, that would be good for me. Thanks

_____

From: “[email protected]” Date: Fri, 4 Sep 2009 00:17:32 0200 To: Patrick Mahony<[email protected]> Subject: Re: Our Discussion

14242886677 usa 60125909999 msian

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Fri, 4 Sep 2009 00:04:58 0200 To: [email protected]<[email protected]> Subject: RE: Our Discussion

What is your mobile?

From: [email protected] [mailto:[email protected]] Sent: Friday, 04 September, 2009 12:00 AM To: Patrick Mahony; Tarek Obaid; [email protected]; [email protected] Subject: Re: Our Discussion

Great

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Thu, 3 Sep 2009 23:58:25 0200 To: [email protected]<[email protected]>; Tarek Obaid<[email protected]>; [email protected]<[email protected]>; [email protected]<[email protected]> Subject: RE: Our Discussion

Mobile is 41 78 86 888 68. I’ll be staying at the London, which is near time warner. I’ll touch base with you Sunday when i get there and we can make a plan for Monday

From: [email protected] [mailto:[email protected]] Sent: Thursday, 03 September, 2009 10:41 PM To: Patrick Mahony; Tarek Obaid; [email protected]; [email protected] Subject: Re: Our Discussion

What’s your mobile?

I can meet anytime on monday at my place, or your hotel. Am staying near Mandarin Time Warner Hotel.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Thu, 3 Sep 2009 00:17:21 0200 To: [email protected]<[email protected]>; Tarek Obaid<[email protected]>; [email protected]<[email protected]>; [email protected]<[email protected]> Subject: RE: Our Discussion

Jho – thanks for agreeing to see me Monday, even though it is labour day. Unfortunately i need to be back in Europe mid-week as i have my sister’s wedding. I plan to arrive in NYC Sunday afternoon and be there all of Monday. I can meet you Sunday for dinner or we can just meet Monday – let me know what works for you and where you would like to meet. Thanks. Patrick

From: [email protected] [mailto:[email protected]] Sent: Friday, 28 August, 2009 2:13 AM To: Patrick Mahony; Tarek Obaid; [email protected]; [email protected] Subject: Re: Our Discussion

Okay. Thanks.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Fri, 28 Aug 2009 01:53:01 0200 To: [email protected]<[email protected]>; Tarek Obaid<[email protected]> Subject: RE: Our Discussion

Monday 7th is labor day so i’ll come after that. Will let you know as i firm up my schedule but will aim to arrive tuesday/wednesday. Thanks

From: [email protected] [mailto:[email protected]] Sent: Friday, 28 August, 2009 1:46 AM To: Patrick Mahony; Tarek Obaid Subject: Re: Our Discussion

Anytime then works for me, just let me know when works best for u.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony Date: Fri, 28 Aug 2009 01:34:51 0200 To: Tarek Obaid<[email protected]>; [email protected]<[email protected]> Subject: RE: Our Discussion

Jho,

Apparently you are NYC-based – it would be my pleasure to meet you there. Next week is a bit tough but how about the week after, week of sept 7th?

Let me know if that works for you.

Thanks.

Patrick

From: Tarek Obaid Sent: Thursday, 27 August, 2009 12:11 PM To: [email protected]; Patrick Mahony Subject: Our Discussion

Jho,

As per our conversation yesterday, I am introducing Patrick Mahony, Head for International M&A, PetroSaudi International Ltd. I have informed Patrick of our discussion, and I leave it to both of you to meet up soonest, to move forward……. Many thanks, Patricks cell phone is 41788688868 — Tarek E. A. Obaid Chief Executive Officer PetroSaudi International Corporation 11 Rue General-Du-Four 1204 Geneva, Switzerland Telephone:- 4122-818-6119 Facsimile :- 4122-818-6118 E mail:- [email protected] www.petrosaudi.com

Email trail 2 – “Proposed timeline for joint venture with PetroSaudi”

After this New York meeting a second email trail pops up in the database, the subject being ‘Proposed timeline for joint venture with PetroSaudi’. It is kicked off by Seet Li Lin, who was the side-kick for Jho Low in his companies of the time with an email written the day after the New York meeting, and continues over the next couple of days until Mahony starts to send back a set of documents and proposals about PetroSaudi and how the company’s ventures might be presented on 11th September. The email trail (which reads backwards in terms of timeline) shows exactly what happened after the meeting and also what Jho Low was aiming to achieve and who he was answering to. The first communication from Seet on 9th September says:

“Dear Patrick, Jho has spoken to the top boss and received the following guidance: 1) Target to close a deal by 20th Sept where all agreements are signed and monies can be paid to PetroSaudi before end of Sept. 2) Arrange for official signing and meeting of dignitaries by end Sept The key thing is the list of assets currently in PetroSaudi, their valuation and descriptions in order for us to proceed and drill down to the numbers. Thanks”

Readers are invited to reach their conclusions as to whom Jho Low’s “top boss” in this instance might be. Sarawak Report believes the only person he could be referring to is Najib Razak – legally the sole beneficial shareholder and signatory to 1MDB. What was clear was that Low wanted to fix some kind of deal by the end of the very same month – money was apparently burning in his pocket:

“We need to move fast n we need as much detailed info u have as fast as possible. We want to sign and pay by sept 09. Wil be emailing out a timeline.”

Sender: [email protected]

Subject: Re: Proposed timeline for JV with PetroSaudi

Message-Id: <887803087.5294037.1252637957618.JavaMail.rim@bda203.bisx.produk.on.blackberry>

To: [email protected]

To: [email protected]

To: [email protected]

Cc: [email protected]

Subject: Re: Proposed timeline for JV with PetroSaudi

From:”Patrick Mahony” <[email protected]>

Date: 11/09/2009 03:59

To:Seet Li Lin; Taek Jho Low; Tarek Obaid

CC: Tiffany Heah

Great. Thanks. I’ll let you go over them and then let’s maybe have a call or organise a place/time to meet to discuss. I’ll wait to hear from you. Thanks

_____

From: “[email protected]”

Date: Fri, 11 Sep 2009 04:42:56 0200

To: Patrick Mahony<[email protected]>; Jho Low (gmail)<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

Hi,

I have got all 5 emails.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony

Date: Fri, 11 Sep 2009 04:42:12 0200

To: [email protected]<[email protected]>; Seet Li Lin<[email protected]>; Tarek Obaid<[email protected]>

Subject: RE: Proposed timeline for JV with PetroSaudi

Jho – you should now have received 5 emails from me. One with a cover note on our potentials deals and areas where we can work together and then four others with presentations on the various opportunities. Please confirm receipt. Thanks

From: [email protected] [mailto:[email protected]]

Sent: Friday, 11 September, 2009 12:52 AM

To: Patrick Mahony; Seet Li Lin; Tarek Obaid

Cc: Tiffany Heah

Subject: Re: Proposed timeline for JV with PetroSaudi

Great.

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony

Date: Fri, 11 Sep 2009 00:55:57 0200

To: Taek Jho Low<[email protected]>; Seet Li Lin<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

Jho – fully understood. I have been preparing virtual datarooms for you, which we will give you access to. In terms of me emailing you the potential deals and some info, I apologise for the delay but we were working on signing a deal this week, which we finally did late last night and this has taken a lot of my time. I have also been in a different city everyday since I left you in new york. I am preparing something to send to you and you will get it overnight tonight. Thanks

_____

From: “[email protected]”

Date: Thu, 10 Sep 2009 23:15:17 0200

To: [email protected]<[email protected]>; Patrick Mahony<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

We need to move fast n we need as much detailed info u have as fast as possible. We want to sign and pay by sept 09. Wil be emailing out a timeline.

Sent via BlackBerry from T-Mobile

_____

From: [email protected]

Date: Thu, 10 Sep 2009 21:13:12 0000

To: Patrick Mahony<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

Hi Patrick,

Are you guys going to include the waste mgmt company as one of the assets? That would fall under our radar as well. Can you please include it?

Thanks

Sent via BlackBerry from T-Mobile

_____

From: Patrick Mahony

Date: Wed, 9 Sep 2009 20:13:40 0200

To: Seet Li Lin<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

Yup – on my end should be me and tarek cc’ed on everything. Thanks

_____

From: SEET Li Lin

Date: Wed, 9 Sep 2009 19:52:19 0200

To: Patrick Mahony<[email protected]>; Tarek Obaid<[email protected]>

Subject: Re: Proposed timeline for JV with PetroSaudi

Dear Tarek,

FYI. Jho has instructed me to keep you posted on our progress.

Regards

Seet

On Wed, Sep 9, 2009 at 12:34 PM, Patrick Mahony <[email protected]> wrote:

I am gathering presentations for you and you will have an email from me latest tomorrow morning my time. This is good news. Many thanks. Patrick

_____

From: SEET Li Lin

Date: Wed, 9 Sep 2009 18:28:58 0200

To: Patrick Mahony<[email protected]>

Subject: Proposed timeline for JV with PetroSaudi

Dear Patrick,

Jho has spoken to the top boss and received the following guidance:

1) Target to close a deal by 20th Sept where all agreements are signed and monies can be paid to PetroSaudi before end of Sept.

2) Arrange for official signing and meeting of dignitaries by end Sept

The key thing is the list of assets currently in PetroSaudi, their valuation and descriptions in order for us to proceed and drill down to the numbers.

Thanks

The requirement in this trail above was for PetroSaudi to come up sharpish with some data that showed what the company was apparently worth and the various things they were looking for joint investors in.

There was a waste management venture apparently, with a company called GEMS, whose online presence does not immediately provide clues as to the ownership of. Jho had seemed enthusiastic about promoting this idea, however Mahony rather backed off in the correspondence.

In fact, it was taking Mahony more than a day or so to come up with the data about PetroSaudi, which is not surprising, because the information which Sarawak Report has gathered on the company at that time indicates that it was a very small operation, working out of hired office space in Victoria and borrowing a phone and address in an office run by one of Tarek’s friends in Geneva, Xavier Justo.

Nevertheless, by 11th September Mahony started responding to the evidently hurried requests of the guys in New York – Jho, Seet and Tiffany Heah.

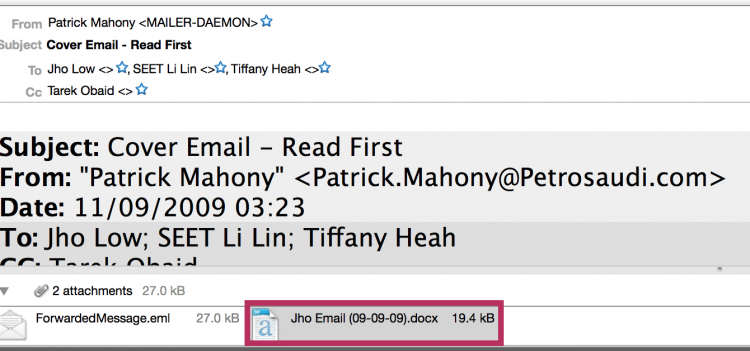

Email trail 3 – Subject “Cover Email Read First”

This trail shows quite a lot of encrypted data slipping into the communications… however the attachments were not encrypted and are plain to read. The first of these emails was sent September 11th from Mahony to the New York team, copied as agreed to Tarek, and it contains a revealing note on the September 8th meeting, dated by Mahony as being written on 9th September.

In this note, Mahony writes that PetroSaudi would be happy to “act as a front” for Jho Low’s further deals. He also introduces a fascinating theme, which indicates that Petronas had clearly been mooted by Jho Low as being a potential investor in these plans, as well as 1MDB.

Sender: [email protected]

Subject: Cover Email – Read First

Message-Id: <D70640398F2EFA448B3B6E626CE46FB70A0B50851B@PETROSRV.petrosaudi.local>

ForwardedMessage.eml

Subject:

Cover Email – Read First

From:

“Patrick Mahony” <[email protected]>

Date:

11/09/2009 03:23

To:

Jho Low; SEET Li Lin; Tiffany Heah

CC:

Tarek Obaid

Jho Email (09-09-09).docx

PK\”%ã·øåÙƒÑÚšl µw%ë=–“^i7 ÙÇä%¿g&á”0ÞAÉ6€l4¼¾L60#´Ã’ÍS

œ£œƒXø”ÒÙÞH¡w”ë„™ìw̤ھ½£ ºPÛ^æôçËOÖ›ƒ›Ô;§<¯aYÕ Ø›`Gßkxm·‹PYÈ[š‚g

Attached to the email was a document named Jho Email (09.09.09)

The content of the document is below:

Jho / Seet / Tiffany,

Many thanks for your time the other day. As discussed, there seems to be a number of things we can do together. However, I think we should try to focus on the more actionable ones for now and we can then spend more time exploring some of the other areas where we might be able to cooperate. In my mind, the immediate businesses to focus on are upstream oil and gas and oil services through PetroSaudi International (PSI) and related companies. Other than that, there are more opportunities we can discuss and I will mention them later. What I have tried to do below is break out the various deals and what some next steps might be. I will also be sending you presentations in separate emails (files are too big to send in one email) to give you more detail on each opportunity.

PetroSaudi – Upstream

This is the main deal and the first one we should work on together. The opportunity here is to buy into a platform with assets in Argentina and Turkmenistan at the moment but with good access to other assets in the Caspian, Middle East, Latin America and West Africa. There are many deals PSI on offer to PSI at the moment and, with the right financial and technical partner, we could close these quickly.

I have sent you for your reference a brief presentation on PSI and a quick one-pager on what the PSI story is and what the opportunity is for an investor/partner.

Briefly, we can value the Argentinean assets at around $50-$75m and the Turkmenistan asset at around $700m pre-border dispute being resolved and $1b-$1.5b after the border dispute is resolved. Argentina has approximately 30m barrels of oil and Turkmenistan 500m. If we do the deal we want with the Canadian company that currently owns the asset in Turkmenistan, we will also pick up a block in the Gambia but the value of this unclear at this point. Argentina also merits a good amount of discussion because there are different ways to look at this and it depends on our partner’s appetite for Argentina.

I think what would make sense is that we set up a joint venture where we contribute our assets and you can contribute cash to match our asset base. We can then decide where that cash goes. Some of it may go to paying us back for some cost and some should stay in the JV for new acquisitions. We can discuss how those acquisitions will work and how money should flow once we do the deals through the JV.

We also have a solid, experienced operating team in PSI and we can use them to work with Petronas when we decide it is time for Petronas to enter the JV or the assets directly. I am assuming here that 1MDB will be our partner first and that Petronas will come in later. If this is the case, we can have Petronas either come into the JV or partner with us directly at the asset level and fund the development costs. I somewhat favour the latter as this would guarantee funding for the assets for development and it is also very standard in the industry to have farm-ins by technical partners. Over time, Petronas could buy the JV and both PSI and 1MDB would have made a big return on the initial investment. This is just a thought on structure, we can obviously discuss what you have in mind and what you think would be appropriate. We can also merge our Turkmenistan asset with the one Petronas has (would make sense).

Lastly, we know there are deals you are looking at where you may want to use PSI as a front, we would be happy to do that. You need to let us know where. We can, for example, buy one oil and gas company in Indonesia (called Star Energy – I have guaranteed access to that deal) and could use that as a platform. On this idea of being a front, we need your input but if Indonesia is one place where you would like to be, we could buy this as a local platform to do more deals.

In Summary, I think PSI in upstream is the first deal we should look at together. I think we should aim at answering the following questions as a next step:

- Who will be the partner in the JV with PSI? 1MDB or Petronas?

- What is the right structure?

- How do you want to run DD on this? I have set up virtual data rooms for both Turkmenistan and Argentina but you need to help us help you and let us know what sort of teams will be conducting DD for you, what info they will want etc. From our side our full technical team out of London will be available to assist you and your team in your technical/asset DD. However any discussion on the JV and how that will work will only be with Tarek and me.

- What is a realistic timeline to close a deal (I think this will depend somewhat on 2 above)?

PetroSaudi – Oil Services

PSI has recently gotten involved in oil services through Ashmore, the emerging market fund manager I was telling you about. Ashmore owns a company called Neptune that has two drill ships and a semi-submersible and company called Rubicon that owns FPSO’s (Floating, Production, Storage and Offloading vessels). PSI has options to buy into these companies or buy them outright. (I have sent you presentations on both Neptune and Rubicon.)

Furthermore, PSI is in the process of forming a JV with Venezuela’s national oil company (PDVSA) to do oil services in Venezuela. There is a big opportunity here because many companies (Halliburton etc) are either looking to get out of Venezuela or are being forced out. What we are doing is taking over these assets (cheaply) and putting them in a JV with PDVSA, where PDVSA would guarantee very long term contracts on the assets. Venezuela has rapidly declining production and a big need to reverse this so the government is very focused on the country’s services industry and making sure Venezuela’s exploration and production is being looked after properly. We can easily invest quite a bit of money into this JV and get a fast return on cash through the contracts PDVSA would give the JV. We could also put some of the Neptune or Rubicon assets in this JV.

Another deal in this space is with the Schahin group in Brazil. Schahin are a very large construction and finance group in Brazil and the head of the group runs the Brazil-Arab Chamber of Commerce (which is how we know him). After making it big in construction and finance, Schahin decided to enter the offshore oil services sector, realising that Petrobras would be driving global demand for this industry going forward. They have since bought drill ships and semi-submersibles and have them all contracted out to Petrobras (this is rare in the industry, most people buy vessels and then look for contracts – here the contracts are there so revenue is guaranteed once the vessel is ready for service). Some of the vessels are still in ship yards in Korea and China and these require financing to complete them. The deal here is to provide Schahin with financing so that the ships get built and can start working on the guaranteed contracts from Petrobras. Schahin is already the largest offshore oil services company in Brazil and the opportunity here is to become a partner/shareholder in this company. This would put anybody who is serious about offshore oil services instantly in the country that will control approximately 30% of the offshore oil services market for the foreseeable future. We like this deal a lot and the partner, Schahin, is a stellar, blue-chip group in Brazil. Investment required here is approximately $600m.

In summary, the offshore oil services space is very interesting to us as it is an asset-intensive business that generates large, steady cash flow (day rates on these vessels are from $100k per day to $500k per day). You can leverage the assets with banks and the key is getting contracts with national oil companies where, again, the Saudi influence helps (as we have demonstrated in Venezuela). The deals in this space require large numbers so we need an investor with deep pockets if we are going to do this.

As discussed, it is my understanding that MISC, Petronas’ service company, has a desire to become big in this space. If so, we could make MISC larger overnight by selling them Neptune, Rubicon and then having them enter into this JV with the Venezuelan National Oil Company (that the Saudis can control because of the relationship in OPEC) and with Schahin, the largest supplier of offshore vessels to Petrobras, who in turn is the largest contractor of offshore vessels in the world (and where MISC already has an FPSO operating).

Again, there may be a 2-step transaction we can do here by first doing deals with 1MDB before getting MISC in. There is value in consolidating a few assets under one roof before the ultimate owner comes in. So 1MDB and PSI could again make a return on their investment before the ultimate buyer acquires the company. Again – just a thought on structure, you need to tell us what is achievable on your end and who will actually be doing this.

Next steps here would be:

- Determine whether MISC, Petronas or 1MDB have appetite for this space? If so, how much? Between an acquisition of Neptune Rubicon, the JV with PDVSA and the Schahin deal we could be talking up to $2b of cash required (of course some of this is financeable).

- If this is interesting, decide which deals we should do first?

- Discuss structure.

- Let us know timing and how you would want to DD.

Other

As discussed, there are a few other areas we are active in and maybe some other areas you would like to work with us in. Below are areas we would certainly be willing to discuss with you.

- Saudi Arabia – are there any sectors/industries that Malaysia would like to be involved in in KSA? If so, we would be happy to discuss and see how we can help you enter the Kingdom for those areas.

- Waste Management – I have sent you a presentation on this business. As per my email earlier this evening, this is certainly a company and sector we like and we have the right ingredients of technical know-how, experienced management and government support to make this very successful globally. However the company is currently undergoing a bit of a restructuring and overhaul so we will not be ready to discuss M&A opportunities until January. In any case, I think we have plenty to do between now and then.

- Funds – do you invest in funds through Khazanah or any other sovereign pools in Malaysia? As discussed, we have access to a few managers we like and have helped them to get funds to manage from various Saudi sovereign sources. There are opportunities here to also get Malaysian funds under management with these managers and even buy pieces of the management company. There a few deals we can do here but need to understand if a) you have pension, SWF or other money that goes to independent fund managers and b) if you have interest in owning fund management businesses. One interesting structure would be for 1MDB (or another vehicle) to buy a stake in an asset management company (we have a few with teams with good track records) and then make sure that funds come in from whichever sovereign sources. We can discuss.

- Real Estate – we are putting together a fund (see presentation emailed) that will manage Saudi sovereign funds to invest in UK real estate. There is a benefit from being a sovereign investor in UK real estate because you don’t pay capital gains taxes. The idea here is to start with UK but then raise more Saudi sovereign funds over time and grow this to buy real estate internationally. We have a good team set up and are ready to go on this. We thought maybe we could make this a fund with both Malaysian and Saudi investors – a sort of joint Malaysian/Saudi real estate fund. We will own the management company here so we will obviously give a piece of it to whoever can bring funds to manage. Again, we can discuss.

- Other – we are happy to discuss anything from your end you would like us involved in.

I have tried to list the main things we are involved with above and have been very transparent. I know I don’t need to say this but a lot of the information I have given you is very confidential and the principals involved here would prefer to keep it that way. The idea is to be open so we don’t waste any time and can quickly see what we can do together.

I suggest we meet again soon to discuss all of this. We really need to nail down what deals interest you, structures and how funds would flow. What I have tried to think of here are deals that are very standard in the industries we are talking about and would therefore be very justifiable to any investment committee. I am also thinking of structures where funds need to move a few times, which generally makes it easier for any fees we would need to pay our agents.

I look forward to hearing from you.

Best,

Patrick

This email from Mahony makes very clear what his suggested plan is. 1MDB should insert money to the joint venture (without any strings attached) and PSI should insert its alleged assets and that some of the 1MDB money should go to PSI to cover alleged costs:

“I think what would make sense is that we set up a joint venture where we contribute our assets and you can contribute cash to match our asset base. We can then decide where that cash goes. Some of it may go to paying us back for some cost and some should stay in the JV for new acquisitions. We can discuss how those acquisitions will work and how money should flow once we do the deals through the JV.”

Mahony goes on to suggest the long-term plan should be that Petronas should be brought in to buy out the whole junket with a fat profit anticipated for 1MDB and PSI – how handy to have a state oil firm on hand to direct to ones own ends!

“I am assuming here that 1MDB will be our partner first and that Petronas will come in later. If this is the case, we can have Petronas either come into the JV or partner with us directly at the asset level and fund the development costs. I somewhat favour the latter as this would guarantee funding for the assets for development and it is also very standard in the industry to have farm-ins by technical partners. Over time, Petronas could buy the JV and both PSI and 1MDB would have made a big return on the initial investment.”

Finally, he makes a kind gesture saying that he is happy for Jho Low in return to use PetroSaudi “as a front” for his other deals. Just let him know where, he asks.

“Lastly, we know there are deals you are looking at where you may want to use PSI as a front, we would be happy to do that. You need to let us know where.”

Email trail 4 – Subject “PSI Presentations”

The next set of emails were follow ups from Patrick entitled “PSI Presentations”. These supposedly addressed the more detailed information that Jho had been asking for about his company, which Malaysia appeared so keen on investing in.

First came the “PSI Story”, as explained by Mahony – and what a story it was. According to this narrative sent to Jho Low and his partners on 11th September 2009 PSI was occupying a unique position as a “quasi Saudi state company” because it was owned by Prince Turki.

“Governments have been very welcoming to PSI because they feel they are working with a quasi-sovereign entity (given that it is a vehicle of the Saudi Royal Family) and one that understands them. So PSI has had privileged access to many hydrocarbon regions in the world (the Caspian, Africa, Latin America) and is currently acquiring assets in these regions…….Furthermore PSI has full support from the Kingdom’s diplomatic corps when entering and operating in these countries.”

Given so much of all this is fluffed up fantasy and that PSI was at that time little more than a paper entity, one starts to wonder to what extent the boys from PetroSaudi had gulled their new Malaysian friends – or to what extent Jho Low really cared.

Certainly, if Low knew he was being lied to he didn’t say, but rather pressed on with a plan that involved using PetroSaudi as a front to siphon US$700 million from 1MDB into his own bank account at Good Star Limited, a Seychelles company

Subject: PSI Presentations

From: “Patrick Mahony” <[email protected]>

Date: 11/09/2009 03:25

To: Jho Low; SEET Li Lin; Tiffany Heah

CC:Tarek Obaid

Basic story on PetroSaudi (PSI):

PSI was founded by HRH Prince Turki bin Abdullah bin Abdulaziz al Saud (the son of King Abdullah, the current King of Saudi Arabia) and Tarek Essam Obaid (from a prominent business family in KSA). PSI was set up to take advantage of the desire of many countries with oil and gas reserves not to hand over their resources over to the big multinationals (Shell, BP, Exxon etc) and to work with governments or companies that they believe are more like-minded and not just trying to make massive profits off of hydrocarbons they feel belong to them. Many of these countries do not have the money or technology to exploit their resources so they do need to work with partners. Saudi Arabia is an obvious choice of as it has both the capital and the significant expertise through its national oil company, Aramco (the largest oil company in the world). Unfortunately though, Aramco’s mandate does not allow it to own upstream assets outside of KSA. It can own downstream assets (though it is currently divesting these, for example the refinery in the Philippines that Ashmore recently purchased from them) but not upstream. As such, Prince Turki and Tarek saw an opportunity to bring Saudi capital and technology to nations that needed it to develop their hydrocarbon industry through a private vehicle, PetroSaudi.

PSI’s aim is to approach nations with strong ties to Saudi Arabia and use the friendly relationship with these governments to give it access to upstream oil and gas assets. Governments have been very welcoming to PSI because they feel they are working with a quasi-sovereign entity (given that it is a vehicle of the Saudi Royal Family) and one that understands them. So PSI has had privileged access to many hydrocarbon regions in the world (the Caspian, Africa, Latin America) and is currently acquiring assets in these regions. Unfortunately though the scale that PSI is reaching is rapidly becoming a bit big for it and the resources required are very large so PSI needs a partner that has a) the appetite for the oil and b) the capital, technical and human resources to help it progress and develop all of the assets it is accessing. Of course PSI has been approached by all of the majors, the Chinese etc but, like the governments it is working with, PSI wants to work with a like-minded partner and one that understands the sensitivities around how PSI is leveraging off of the Kingdom’s relationships to gain access to these hydrocarbons. It is very important that any partner understands KSA well and also appreciates the reasons why PSI is allowed to operate in a given country.

This is a pretty unique opportunity for an oil and gas company or an investor to partner with a vehicle that will grant it unrivalled access to many hydrocarbon regions of the world and can also protect any investment they make in these regions. This last point is important because as you can see with Shell in Nigeria, BP in Russia, many countries will get a company in but then bully it around once it is there and has sunk many dollars in the ground. This will not happen with PSI because these nations do not want to get on the wrong side of the Saudi Royal Family (you have to remember that Saudi matters hugely in the oil world and there is a lot of Saudi aid to these countries, some are fellow Muslim nations etc.). The first point is important too because many of these countries cannot even access some countries that PSI is already operating in. Furthermore PSI has full support from the Kingdom’s diplomatic corps when entering and operating in these countries.

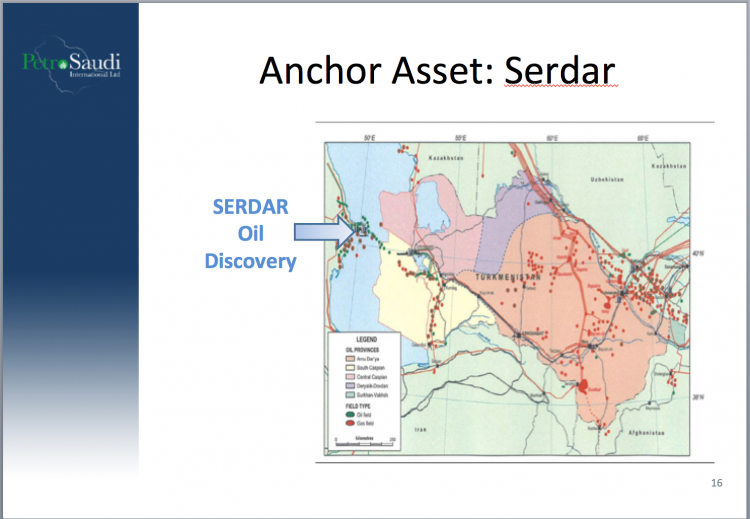

The power point presentation on PSI that Mahony also provided Jho Low is equally informative in that it makes it clear that the later claim that PSI owned as an “anchor asset”, an oil field in Turkmenistan worth over a billion dollars was false. This presentation and subsequent email conversations with Low make clear that the proposal was to use the injection of cash from 1MDB to acquire the Serdar field and not the other way around.

SEE THE FULL POWER POINT PRESENTATION

Other emails being sent from PSI at the very same time also make perfectly clear that PSI was at that very time still trying to find out if it was worth making some sort of investment with the company which did own Serdar, the Cypriot registered Buried Hill Energy.

This did not stop Mahony from suggesting (as we have seen) that PSI be granted some ‘costs’ for injecting its virtually non-existent assets into the joint venture… later this concept morphed into the concept of a loan injected by the PSI holding company into the subsidiary it created to enter into the joint venture, which 1MDB would then commit to paying back!

One statement Jho Low was to make in a later email trail summed the attitude of these negotiators up perfectly. He suggested they needed to “work backwards” ie to work out their objectives and then come up with valuations to fit those purposes!

“Valuation figure. We need to work backwards, with the objectives above in mind to produce the right valuation”.

Email trail 5 – Setting up The Turkmenistan PSI subsidiary Sept 11th 2009

Meanwhile, on the very same day that Mahony was sending out this presentation, 11th September, another branch of PSI was setting up in the Jersey tax haven the subsidiary company PSI Turkmenistan under Tarek Obaid that would just a few days later be claiming to 1MDB and its Board Members that it already owned the oil field!

According to the emails there were major concerns about the regulators given the failure of Obaid to provide proper details about the shareholding Prince in the venture. These concerns were overcome by a reference letter produced by the PSI Swiss Bank, JP Morgan

ÐÏࡱá211, Al Faisaliah Residence

Riyadh 11491

Kingdom of Saudi Arabia

Date 11th August 2009

To the Directors of:

PetroSaudi Turkmenistan 1 Limited

Third Floor, Mielles House

La Rue des Mielles

St Helier

Jersey, JE2 3QD

Dear Sirs

I, Tarik Bin Isam Bin Ahmed Obaid in pursuance of the power contained in the Articles of Association of the Company do hereby nominate and appoint John K. Shield, whom failing Paul A. Le Marquand, to act as alternate in my place at a meeting of the Directors to be held on the 11th August 2009 or at any adjournment thereof, which I am unable to attend and to exercise all my duties as a Director of the Company.

The purpose of the Meeting is to consider and approve the following:

1. The establishment and registration of the Company’s branch office in

Ashgabat, Turkmenistan.

2. To authorise Paul Le Marquand to sign and execute such documents as may be

required for and on behalf of the Company in relation to the registration of the branch office in Turkmenistan.

3. To approve the preparation of the bylaws of the branch office in Turkmenistan

in the Turkmen and Russian language.

4. To grant a Power of Attorney in favour of Mr. Nigel J. Douglas in order that he may do all things necessary in relation to the establishment and operations of the Company’s branch office in Turkmenistan.

5. To appoint Mr. Nigel J. Douglas as the Director of the Company’s branch

office in Turkmenistan.

6. To grant a Power of Attorney in favour of Mr. Kuznesow Aleksey Vitalyevich in order that he may make the application for registration of the Company’s branch office with the Ministry of Economy and Development of Turkmenistan and do all things necessary at any government and/or private authorities of Turkmenistan related to the registration of the branch office of the Company in Turkmenistan

Please provide me with a copy of the minutes of the Meeting in due course.

Yours faithfully

Tarik Bin Isam Bin Ahmed Obaid

Sender: [email protected]

Subject: PT / JPM

Message-Id: <425826616.5312845.1252662812437.JavaMail.rim@bda203.bisx.produk.on.blackberry>

ForwardedMessage.eml

Subject:

PT / JPM

From:

“Patrick Mahony” <[email protected]>

Date:

11/09/2009 10:53

To:

Tarek Obaid

CC:

David Blewden

Tarek,

For our jersey company that we have set up to hold turkmenistan, the management company we hired agreed not to do any KYC on PT (even if not a direct shareholder, he is involved in PSI so they would need to KYC him). However what would give them a lot of comfort is if one of PT’s banks could write them a letter of good standing for PT (something simple saying they know him etc). David is in contact with jon conner for opening up the accounts and jon mentioned that he would have no problem writing such a letter but that he needs PT’s approval first. Could you please organise this with jon? David can then give him a form of the letter that jon can put on JPM letterhead.

Thanks

Sender: [email protected]

Subject: Re: Bank account

Message-Id: <[email protected]>

Recipient: [email protected]

ForwardedMessage.eml

Subject:

Re: Bank account

From:

“Paul Le Marquand – Fiduciary Management Limited” <[email protected]>

Date:

11/09/2009 11:40

To:

David Blewden

Hi David,

I agree that this would go against what we are trying to achieve from a

M & M point of view. We also have obligations to meet in relation to

the regulations imposed on us as we would not have control over the flow

of funds – therefore the ability to monitor transactions is much

reduced.

Thanks,

Paul

On Fri, 11 Sep 2009 12:17:39 0200, “David Blewden”

<[email protected]> said:

> Paul,

>

> Tarek has asked that he has ability so sign alone on the PST1L bank

> account. I’m not sure this works as it would seem to be contrary to our

> efforts to ensure the mind and management is really in Jersey, do you

> agree?

>

> Thanks

>

> David

>

Paul A. Le Marquand, Managing Director

Fiduciary Management Limited

Third Floor, Mielles House

La Rue des Mielles

St Helier, Jersey, JE2 3QD

Channel Islands

email: [email protected]

web: www.fidman.com

Tel: 44 (0)1534 866858

Fax: 44 (0)1534 866859

This message may contain confidential information which is intended for the addressee named above. If you are not the intended recipient of this message you are hereby notified that you must not use, disseminate, copy it in any form or take any action in reliance on it. If you have received this message in error please delete it and any copies of it and notify Fiduciary Management Limited immediately.

Fiduciary Management Limited is regulated by the Jersey Financial Services Commission in the conduct of trust company business.

Sender: [email protected]

Subject: RE: Bank ref for Jersey directors of PST1L

Message-Id: <83F7A3288A69094192A850818614CEEF738BFC94D3@EMBACMS102.exchad.jpmchase.net>

Recipient: [email protected]

ForwardedMessage.eml

Subject:

RE: Bank ref for Jersey directors of PST1L

From:

“Isabelle X Bautista” <[email protected]>

Date:

11/09/2009 13:30

To:

David Blewden

CC:

Jonathan A Conner

David,

Please disregard. Tarek has checked again and agrees to leave the signing authorities as such.

Best regards

Isabelle

From: David Blewden [mailto:[email protected]]

Sent: vendredi, 11. septembre 2009 12:25

To: Isabelle X Bautista

Subject: RE: Bank ref for Jersey directors of PST1L

Isabelle,

Can you clarify please – if Tarek can sign alone, then there’d be no need to give the other directors any signing authority as it would be pointless. I’m not sure this works anyway from the perspective of demonstrating tax residency in Jersey, but let me check.

Thanks

David

From: Isabelle X Bautista [mailto:[email protected]]

Sent: 11 September 2009 11:11

To: David Blewden; Jonathan A Conner

Subject: RE: Bank ref for Jersey directors of PST1L

Hi,

Tarek just came by and signed all the documents. He also mentioned that he would like to be able to sign individually on the account.

I will send the necessary amendment documents to Paul in order to allow for him to sign alone, and the other directors to sign jointly with him.

Best regards

Isabelle

From: David Blewden [mailto:[email protected]]

Sent: vendredi, 11. septembre 2009 12:09

To: Jonathan A Conner

Cc: Isabelle X Bautista

Subject: Bank ref for Jersey directors of PST1L

Jon,

As you know 3 of the directors of PST1L are from the Jersey trust company FML. They have long been agitated that they weren’t able to do proper KYC on Prince Turki. Isabelle mentioned that JPM could possible provide a bank reference but would need PT’s approval first. We’d like to go ahead with this please – Tarek will probably be giving you a call.

Many thanks

David

Sender: [email protected]

Subject: Re: PT / JPM

Message-Id: <C6D066A3.22B2%[email protected]>

Recipient: [email protected]

Recipient: [email protected]

ForwardedMessage.eml

Subject:

Re: PT / JPM

From:

“Tarek Obaid” <[email protected]>

Date:

11/09/2009 19:42

To:

Patrick Mahony

CC:

David Blewden

Ill take care of it

On 11/09/2009 11:53, “Patrick Mahony” <[email protected]> wrote:

Tarek,

For our jersey company that we have set up to hold turkmenistan, the management company we hired agreed not to do any KYC on PT (even if not a direct shareholder, he is involved in PSI so they would need to KYC him). However what would give them a lot of comfort is if one of PT’s banks could write them a letter of good standing for PT (something simple saying they know him etc). David is in contact with jon conner for opening up the accounts and jon mentioned that he would have no problem writing such a letter but that he needs PT’s approval first. Could you please organise this with jon? David can then give him a form of the letter that jon can put on JPM letterhead.

Email trail 6 – Subject “Proposed Conference Call”

Having received Patrick Mahony’s key presentations (above) along with a couple of other suggestions for investing in a waste management project and real estate in London, the boys in New York got back early on 14th September with plans for a conference call to push things forward.

Attached was a highly informative series of documents prepared by Jho Low’s team, showing how they envisaged getting into business with PSI. Meanwhile, Jho had plainly rung Tarek and advised him a billion dollars was on hand to invest:

“Dude – on doit fermer avec eux, jho ma reveiller la, et ils sont prets a verser un milliard…………. D ici la fin du mois appelle quand tu te treveille je suis a londres” he emailed Patrick. WOW!

Subject: Proposed conference call: 330pm (US Eastern time)

From: “SEET Li Lin” <[email protected]>

Date: 14/09/2009 06:11

To: Patrick Mahony; [email protected]

CC: Jho Low; Tiffany Heah

Hi Patrick, Tarek,

Jho has gone through the information that Patrick sent us.

Can we do a conference call at 330pm (US Eastern time) on Monday?

Thanks

Sender: [email protected]

Subject: Re: Proposed conference call: 330pm (US Eastern time)

Message-Id: <[email protected]>

Recipient: [email protected]

Recipient: [email protected]

ForwardedMessage.eml

Subject:

Re: Proposed conference call: 330pm (US Eastern time)

From:

“SEET Li Lin” <[email protected]>

Date:

14/09/2009 07:18

To:

Patrick Mahony; [email protected]

CC:

Jho Low; Tiffany Heah

Dear Tarek and Patrick,

We will be using the following set of presentation for our discussion.

Do let me know if the proposed timing is good for you all.

Best,

Seet

Sender: [email protected]

Subject: FW: Proposed conference call: 330pm (US Eastern time)

Message-Id: <C6D3AFF7.22B7%[email protected]>

Recipient: [email protected]

ForwardedMessage.eml

Subject:

FW: Proposed conference call: 330pm (US Eastern time)

From:

“Tarek Obaid” <[email protected]>

Date:

14/09/2009 07:31

To:

Patrick Mahony

Dude – on doit fermer avec eux, jho ma reveiller la, et ils sont prets a verser un milliard…………. D ici la fin du mois appelle quand tu te treveille je suis a londres

—— Forwarded Message

From: SEET Li Lin <[email protected]>

Date: Mon, 14 Sep 2009 08:17:52 0200

To: Patrick Mahony <[email protected]>, Tarek Obaid <[email protected]>

Cc: Jho Low <[email protected]>, Tiffany Heah <[email protected]>

Subject: Re: Proposed conference call: 330pm (US Eastern time)

Dear Tarek and Patrick,

We will be using the following set of presentation for our discussion.

Do let me know if the proposed timing is good for you all.

Best,

Seet

The attached internal presentation provided by Jho Low’s team to provide a background for the upcoming conference call gives a clear indication of what is already being planned for the proposed US$1 billion.

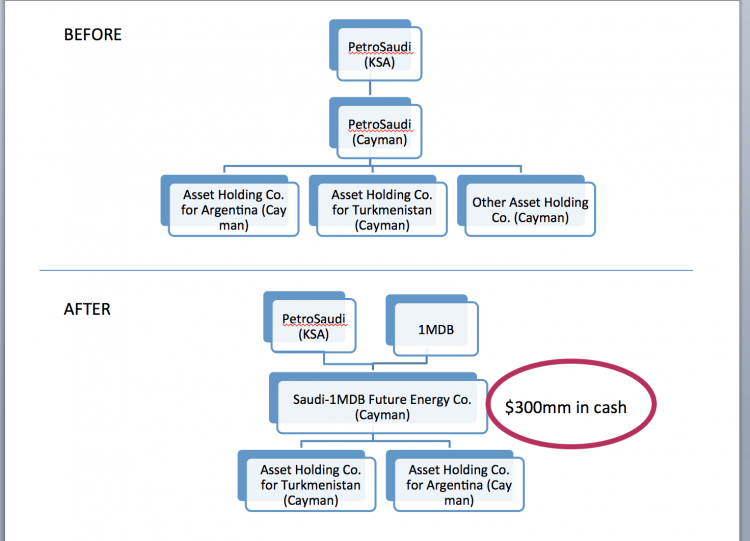

Only US$300 million is illustrated in this power point presentation as being planned for the joint venture company between 1MDB and PetroSaudi – there is no mention of the balance of US$700 million out of the projected billion dollars to be ‘invested’.

The presentation also shows the quite staggering breakneck speed with which Jho Low was planning to put 1MDB’s money into a company, about which just the previous day he had still been sending enquiries as to what it actually owned or did:

SEE FULL POWER POINT HERE

Particularly fascinating is the minuscule role in all this assigned to the team at 1MDB and their CEO Sharhol Halmi, whose one and only job was to get the matter past the board between 26th September and the end of the month.

It was for Jho Low’s New York team, according to the document sent to PSI on September 14th, to draw up and finalise the agreement and sort out the necessary valuation of PetroSaudi. PetroSaudi didn’t need to do much either, except agree, according to the presentation.

Later, in the course of the same day, Seet came up with an updated an elaborated plan, which showed more insight into the conspirators’ breakneck thinking.

Subject: Updated presentation for conference call at 11pm Geneva, 5pm Eastern

From: “SEET Li Lin” <[email protected]>

Date: 14/09/2009 20:31

To: Jho Low; Tiffany Heah; [email protected]; Patrick Mahony

Hi,

added some details. Let’s use this later.

Thanks

SEE THE UPDATED POWER POINT PLAN

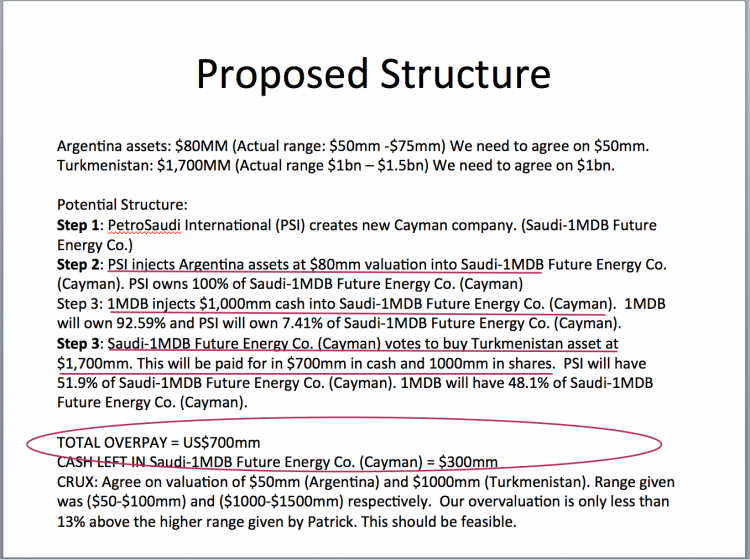

In this up-date Seet makes abundantly clear that this is indeed a procedure whereby the valuations are being planned backwards to achieve the objectives. It also makes clear that the process is geared around explaining the exit of the balance of US$700 million from the billion dollar deal.

In this scenario Seet refers to an “overpay”. As the project was later refined, the exit of the money was to be re-framed as a “loan repayment”.

The objective was consistent, however, which was to exit the US$700 million from the joint venture. It was to be paid into an anonymous account at Coutts Zurich, which turned out to belong to Good Star Limited (Seychelles) – the sole shareholder of which was Jho Low.

Sarawak Report has now made available these individual files to selected journalists worldwide. We will be continuing our examination of the Justo Data in coming articles, in the hope of explaining to readers in fuller detail exactly what the Heist of the Century, which we exposed exactly a year ago, was all about.

Meanwhile, following this conference call, the ever-eager Seet provided this feedback to his four fellow game-players:

Sender: [email protected]

Subject: Summary of parameters and plans

Message-Id: <[email protected]>

Recipient: [email protected]

Recipient: [email protected]

ForwardedMessage.eml

Subject:

Summary of parameters and plans

From:

“SEET Li Lin” <[email protected]>

Date:

15/09/2009 06:06

To:

Jho Low; Tiffany Heah; Patrick Mahony; [email protected]

Hi Patrick,

please find our thoughts on today’s discussion.

Thanks

Objectives to be met:

1) Signing by 30th Sept 2009

2) First tranche of Malaysian investments: US$1,000mm

a. US$280mm will remain in JV company

b. US$720mm will be moved via PSI

c. MDB must hold 49% or less in JV company

3) MDB to recognize approximately US$186mm in revaluation gains due to buying below valuation due to ability to close the deal fast.

Issue Structure:

1. Is it possible to use a BVI for the new JV company instead of Cayman Island company?

2. We will like to structure the US$720mm as a repayment to PSI for loans extended to the JV company or asset.

PATRICK: please improve on our proposed structure as you deem fit.

Issue: Valuer

1. Timeline consideration. Time required to generate report.

2. Valuation figure. We need to work backwards, with the objectives above in mind to produce the right valuation.

Issue: Agreements required

1. For MDB – Joint venture agreement with PSI

a. 5 board members including 1 chairman

b. Chairman will be PSI

c. MDB will nominate 2 members, PSI will nominate 3 members

Issue: Official story

1) MDB is partnering the Saudi royal family to spur sustainable economic development in Malaysia by investing in global renewable and non-renewable energy resources and others.

Issue: Bank Accounts

I. BSI as bankers

II. Company receiving the monies must use same bank as Promoter

III. Payment out of PSI must follow immediately after its receipt at PSI

Meeting in Switzerland

A. Meeting BSI

B. Preparation of various agreements to pay Promoter – $720mm

a. 1 introduction fees to Promoter

b. Several deep in the money derivative contracts in favor of Promoter (with various companies)

Preparation Work

A. Appointment of lawyers by us.

Clarifications:

i. PSI will appoint its own lawyers.

Potential Structure

I. PSI create new BVI company as new joint venture vehicle (PSI-1MDB Future Energy Corporation)

II. PSI sells Argentina asset to PSI-1MDB Future Energy Corporation for US$50mm. This will be funded in shares.

III. PSI sells Turkmenistan asset to PSI-1MDB Future Energy Corporation for US$1720mm. This will be funded by US$1000mm in shares and US$720mm in advances.

IV. 1MDB pays US$1000mm. US$720mm used to clear advances. US$290mm remains in PSI-1MDB Future Energy Corporation. 1MDB should own 48.8% of PSI-1MDB Future Energy Corporation, PSI should own 51.2% of PSI-1MDB Future Energy Corporation.

V. Valuation report should come in to value assets at US$3.285bn. This will result in US$186m gains attributable to the US$1000m investment made by 1MDB.

Key Dates:

18th Sept (Fri) – Meeting in Geneva

30th Sept (Wed) – Prince Turki in Malaysia for official signing

There were some adjustments to be seen in this plan – Jho Low narrowed down his margin by US$20 million for some reason and PSI’s sharp London lawyers, White & Case, were soon injecting their own legal strategies.

But, in the end, just a fortnight later, this extraordinary game-plan had been achieved and Jho Low had carried off his heist. US$700 million safely deposited into his account.

What does this say for the robustness of Malaysia’s institution against public theft and for the conduct of a series of supposedly trustworthy international banking institutions?

Sarawak Report will be continuing its series of minute investigations into the 1MDB deal.