The power point presentation laying out the so-called ‘Integrated Medical Cities’ project, to be underpinned by RM10.64 billion worth of bonds from EPF, is big on grand plans, but scanty on the detailed implementation.

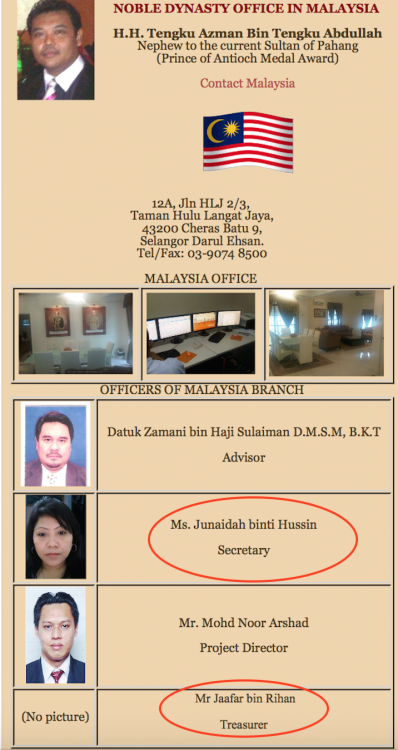

And, three years after agreements were apparently signed, the first of 15 such developments, planned by project coordinator, Junaidah binti Hussin of TJJR Diversified (M) Sdn Bhd, remains visible only as an empty lot in Sabah – the plot has not even yet been purchased, although the bonds were apparently signed over by EPF to support the scheme in August 2015

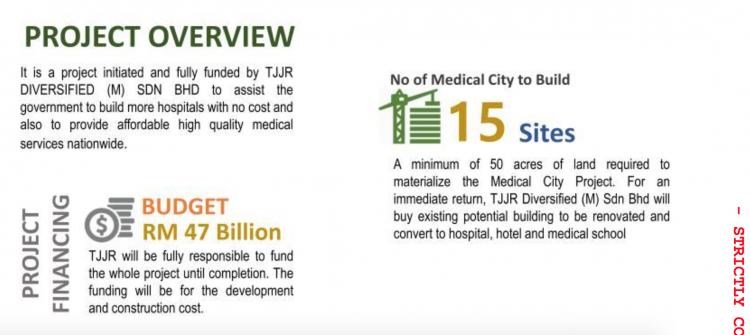

The proposal, originally presented in January 2015, was to build these major complexes across Malaysia, at a cost of an eye-watering budget of RM47 billion.

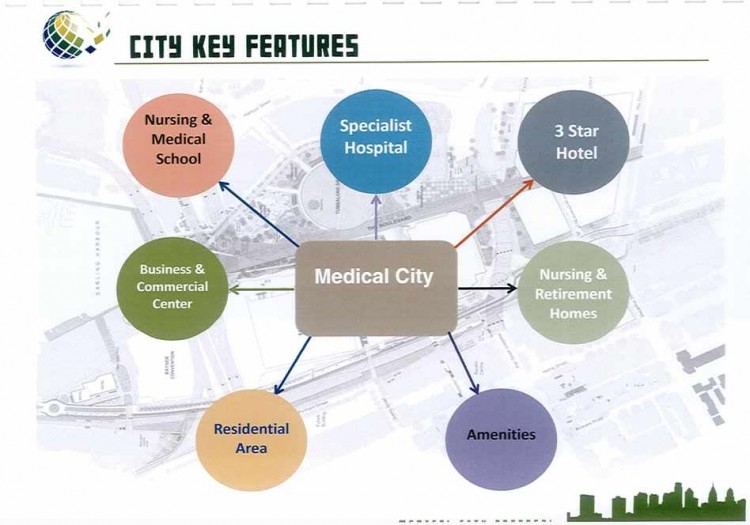

The centres are projected to include specialist units, hotels, nursing schools, business and commercial complexes, retirement homes and residential areas with accommodation for the elderly and is described as a major humanitarian project for the nation, as well as a money-spinner for the investment fund.

And yet the company behind the proposal is a one woman band. TJJR Diversified (M) Sdn Bhd was incorporated in Malaysia in on 29th August 2013 and is owned, save for one share, by a 48 year old law graduate named Junaidah binti Hussin (also known as June Aida Hussin).

In her power point proposal she claims the enterprise will cost the government nothing:

“It is a project… to assist the government to build more hospitals with no cost and also to provide affordable high quality medical services nationwide. TJJR will be fully responsible to fund the whole project until completion..”

This ‘strictly confidential’ project summary was produced by TJJR Diversified (M) in conjunction with an affiliated company with the interesting name of Triple Nice Tales Sdn Bhd, of which Hussin is also a director.

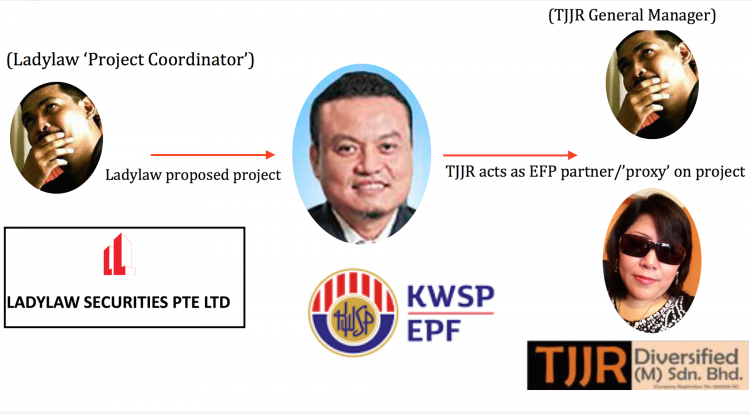

Another key operative on the team is a graduate of interior design from MARA named Azlan Shah Md Radzi, who is described as the CEO/ General Manager of TJJR Diversified (M) and is also a director of Triple Nice Tales.

It seems a daring, if not preposterous, proposal to be put forward by a company controlled by just one woman with no previous experience in managing vast public development projects.

Despite the claim that the enterprise will cost the government nothing, the documentation makes clear that TJJR Diversified (M) is planning to rely on the massive injection of public money, through billions of ringgit of investment by the Employee Provident Fund (EPF), thanks to an alleged collaboration with the Department of Health. EPF comes under the control of the Ministry of Finance.

So, while the government might not be paying directly, the Malaysian public will funding the project at the government’s behest through the country’s state run pension fund, according to the scheme.

There are immediate questions as to why a public savings institution controlled by the Ministry of Finance, would invest in a multi-billion ringgit project managed by the likes of TJJR Diversified (M)?

In the company’s incorporation documents TJJR Diversified (M) laid out its areas of business as “renting and leasing of furniture, pottery, glass and other house wares, as well as the manufacture of precast concrete…. and wholesale of industrial machinery“.

There is no mention of major financial transactions, involving the transfer of billions of dollars or mega-construction projects in Malaysia.

Official Project?

So, is the RM47 billion Integrated Medical City project an official EPF investment or a ‘dark operation’ designed to raise money for the Minister of Finance, as signalled by sources who have alerted Sarawak Report?

EPF has today denied the entire proposal as a ‘forgery’. However, the evidence is too extensive to be easily dismissed.

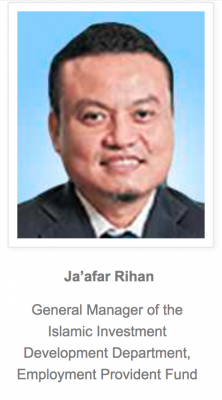

What is indicated by the documents and correspondence is that no other EPF executives apart from, allegedly, General Manager Ja’afar bin Rihan, were officially involved in the decision making process on the project or its funding.

Moreover, Ja’afar appears to have adopted an apparent alias of ‘Jaffar bin Raihan’ half way through the correspondence relating to the project, whilst retaining the same title and ID number. He has denied that this alias is related to him and EPF now says it has reported forgeries to the police.

Timeline of the ‘Hoax’

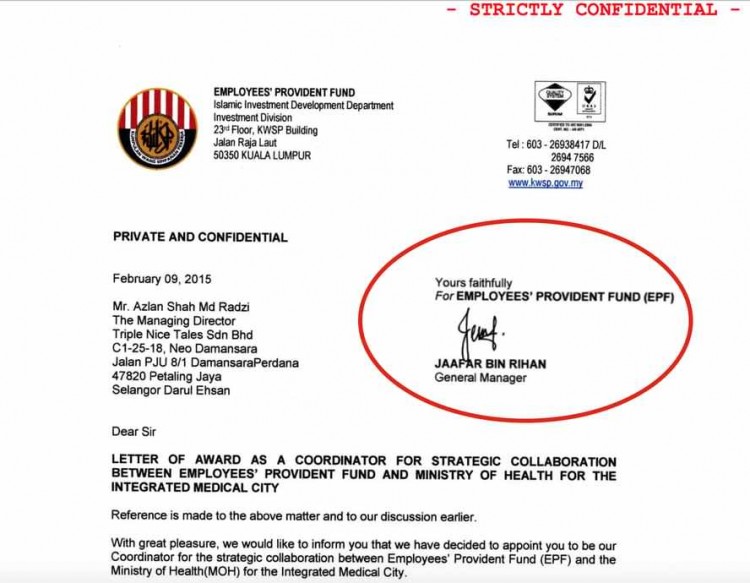

The large body of documents indicate that kicking off the project was an apparent EPF headed letter, signed by Ja’afar bin Rihan in his own name and in his capacity as a General Manager at the fund, clearly identifying him with the initial stages of the idea.

This letter, dated February 9th 2015, purported to award the role of ‘coordinator for strategic collaboration between EPF and the Ministry of Health‘ to one Azlan Shah Md Radzi, in his capacity as a director of Triple Nice Tales Sdn Bhd:

“With great pleasure we would like to inform you that we have decided to appoint you to be our Coordinator for the strategic collaboration between EPF and the Ministry of Health for the Integrated Medical City” the executive wrote apparently on behalf of the fund:

EPF allege the entire matter was forged, however doubt is thrown on the sweeping nature of that claim by the fact that other related documents have been verified by Ladylaw Securities director Nic Manikis, who says he did receive them.

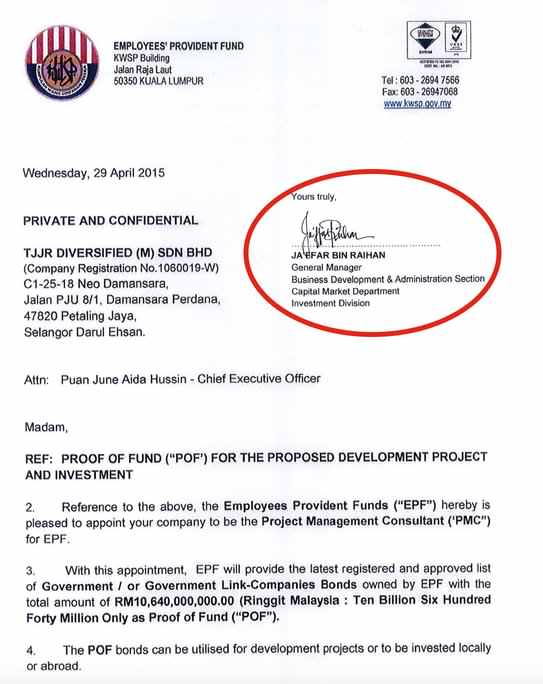

The next step appears to have been a follow up letter on 29th April 2015, this time to the affiliate of Triple Nice Tales Sdn Bhd, which was TJJR Diversified (M). On this occasion the EPF headed letter was signed under the altered name of ‘Jaffar bin Raihan’ but using the same job title as the one Ja’afar bin Rihan himself has regularly used in other correspondence (General Manager, Business Development & Administration Section, Capital Market Department, Investment Division).

This letter appears to be a continuation of the same negotiations and confirmed that EPF had further awarded TJJR Diversified (M), the role of ‘Project Management Consultant’ and stated that the fund had also agreed to put up collateral in the form of RM10.64 billion worth of bonds to back the project:

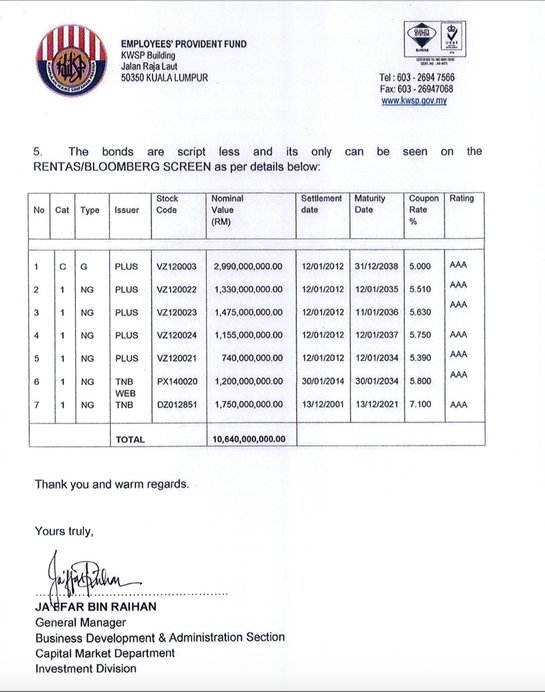

“..EPF hereby is pleased to appoint your company [TJJR] to be the Project Management Consultant for EPF. With this appointment, EPF will provide the latest registered and approved list of Government/or Government Link-Companies Bonds owned by EPF with the total amount of RM10,640,000,000.00 (Ringgit Malaysia: Ten Billion Six Hundred Forty Million Only as Proof of Fund (POF)….”

In this letter the alleged EPF Manager addressed TJJR company director and CEO, Junaidah binti Hussin, by her known alternative name ‘June Aida Hussin’ and signed himself as ‘Jaffar bin Raihan’.

Further documentation relating to this project shows that separate EPF and personal email accounts appear to have been set up under this variation of the spelling of Ja’afar bin Rihan’s name. These have tested to be working email accounts, in that emails have been received not bounced:

Denials From EPF

Late yesterday the Employee Provident Fund issued a lengthy and emphatic denial of the previous article by Sarawak Report outlining its negotiations with two foreign companies run by fraudsters and the evidence that RM10.64 billion in EPF bonds had been diverted as collateral to the hospital project:

In a statement today, EPF said, its has never had any dealings nor entered into any agreements of any sort with Limage Holdings SA, Limage Southwest Holdings, the individual known as Matrai nor any parties as stated by the Sarawak Report.

“As such, no transfer of bonds nor funds of any kind to any of the aforementioned companies, parties or individual could have occurred as alleged,” it said.

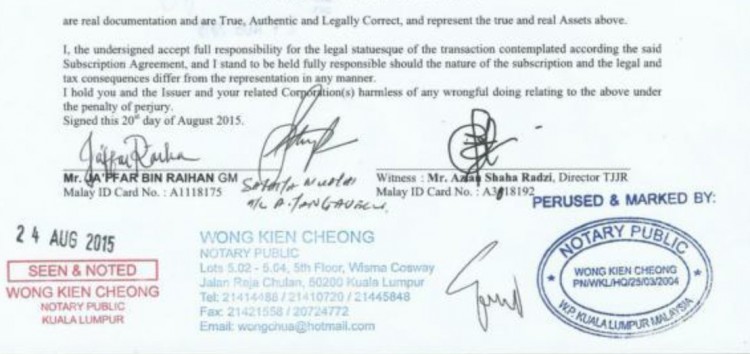

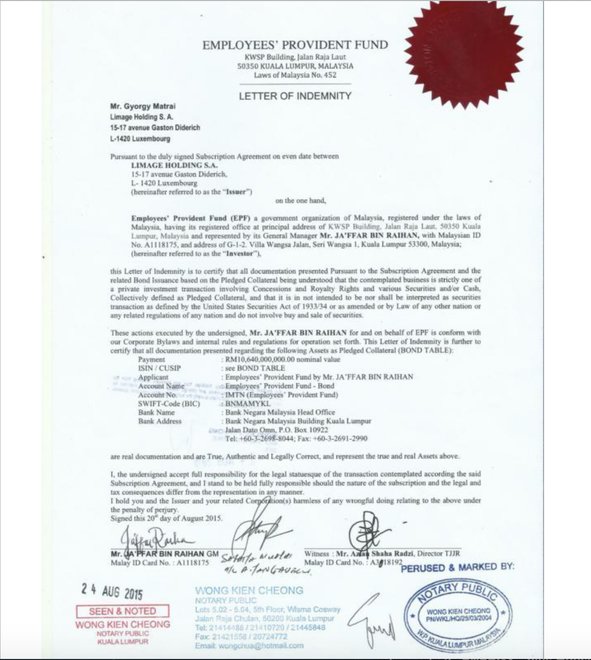

According to EPF, a fake ‘Letter of Indemnity’ dated Aug 20, 2015 addressed to Gyorgy Matrai of Limage Holding S. A. alleging an agreement between the EPF and Limage Holdings S.A. was made known to the EPF on Oct 26, 2015.

“As this was clearly a falsified document, the EPF lodged a police report on Oct 28, 2015.

“A ‘Letter of Award’ (LOA), titled ‘Development and Construction of Integrated Medical City Project For EPF’ from TripleNiceTales Sdn Bhd dated May 18, 2015 was made known to EPF on Feb 24, 2016,” it said.

As there were third parties misusing EPF’s name and suspicion of fraud was involved, EPF said, it lodged a police report on Feb 26, 2016 stating that it has no knowledge nor involvement in the transaction referred to in the LOA. [BERNAMA]

In other words the fund is claiming there has been a bizzare and detailed hoax involving numerous letters, emails and communications stretching over two years for reasons that appear unclear. The matter seems to have been barely investigated.

Moreover, during this whole period, Sarawak Report has learnt, there have been ongoing legal proceedings, initiated by a senior UMNO politician in late 2015, who is claiming what he believes to be his share of commission on the bond deal that EPF is denying ever took place.

The EPF version of events further conflicts with frank and detailed testimony provided to Sarawak Report by the present director of Ladylaw Securities, the Australian former government servant, Nic Manikis, who has confirmed his company did enter negotiations with EPF managers, specifically with Ja’afar bin Rihan.

Indeed, Manikis has confirmed to Sarawak Report that he himself met with Ja’afar bin Rihan and Junaidah binti Hussin (aka June Aida Hussin) of TJJF Diversified at EPF’s headquarters in KL in 2014.

He has also acknowledged that EPF documents relating to him (letter and emails of which Sarawak Report has copies) are in fact genuine not forged.

Manikis has explained that these investment negotiations with Ladylaw Securities, which he believed to be entirely above board, did not reach a conclusion. He has told Sarawak Report that the EPF executive together with Hussin started to appear to focus on the separate hospital project and stopped getting back to his company.

Manikis confirms, nonetheless, that he has since late 2015 been receiving legal demands for an alleged US$20 million (2%) commission on money allegedly raised from EPF on the part of a senior UMNO figure, subsequent to the apparent signing of the alleged deal with Limage Holdings to transfer the bonds in August of that year.

Sarawak Report understands that the legal demands have also been directed at TJJR Diversified (M) as an alleged partner in the planned EPF deals with Ladylaw Securities (as confirmed by Manikis) and also the hospital project involving Limage Holdings.

The series of demands, which have been lodged with Manikis’s Australian lawyers, provide evidence that this politician, who claims he was instrumental in the negotiations, is of the firm belief that the money has indeed been raised from EPF via the assignment of the bonds.

Manikis has indicated he will be contesting the legal demands, which he says are baseless, because although he had promised commission should his firm receive an investment from EPF, no deal was realised with Ladylaw itself. However, today he has commented on EPF’s denials in an email to Sarawak Report:

“So EPF first became aware of Ladylaw in Jan 2017…… really!

Unless of course Jaafar doesn’t work at the EPF….. which I am convinced he does.

EPF awareness of Ladylaw coincides with [XX’s] second letter of demand received in Jan 2017…. I can see how Ladylaw was being drawn into something sinister rather than what we believed to be a relatively straightforward property investment proposal.”

Humanitarian Project?

Contrary to the denials of EPF, Manikis has also confirmed to Sarawak Report, that the alleged devisors of the ‘hoax’ project for the Integrated Medical Cities scheme, namely Azlan Shah Md Radzi and his colleague Junaidah binti Hussin, were already well known to Ja’afar bin Rihan at the time the presentation was produced in January 2015, having interfaced with him at EPF on a series of separate investment proposals over the past few years involving Ladylaw Securities Pte Ltd.

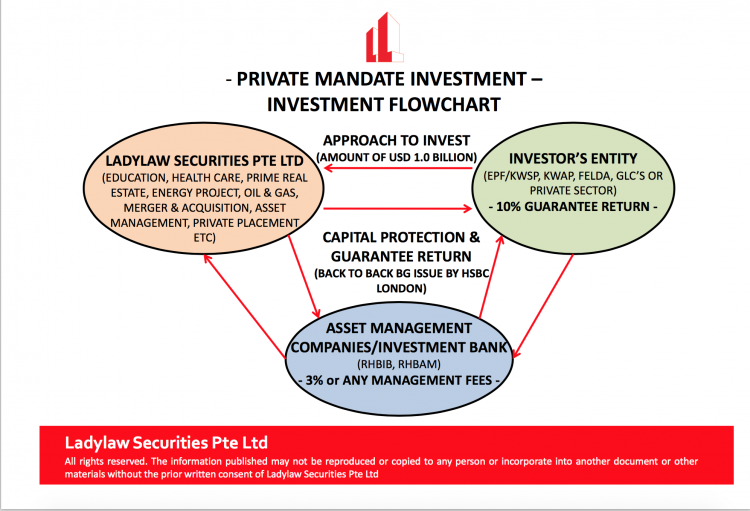

Azlan Shah Md Radzi was, amongst his several other roles, the ‘Project Coordinator’ for Ladylaw Securities, whose directors acknowledge that they worked with both EPF, FELDA and FELCRA officials on a number of billion dollar investment proposals for these and other Ministry of Finance funds since 2012. (see next article)

There is considerable correspondence relating to these negotiations, which makes clear that the Office of the Prime Minister, on the prompting of the Prime Minister himself, was actively supporting Ladylaw’s proposals.

Memos and documents viewed by Sarawak Report show that the founder of Ladylaw Securities, Dr George Miller, made an original approach to the Minister of Finance, Najib Razak, as far back as September 2012, which appears to have been received favourably.

The presentation centred around proposals to purchase mega property investments in Australia and Canada, for which funds such as KWAP, EPF and FELDA would supply Ladylaw securities with billion dollar investments.

Sarawak Report is informed that Najib then personally encouraged the directors of Ladylaw Securities (which by then included Nic Manikis) to make separate presentations to various funds, including EPF and FELDA, to solicit their billion dollar investments in its proposed schemes.

Manikis confirms the correspondence which shows that Azlan Shah Md Radzi was Ladylaw’s ‘Project Coordinator’ in KL and he says that Azlan’s contact at EPF was Ja’afar bin Rihan.

Manikis also confirms that Junaidah binti Hussin and her company TJJR Diversified (M) were brought into the EPF negotiations with Ladylaw by Ja’afar, who described TJJR as EPF’s ‘proxy’. On Ja’afar’s request Manikis had agreed in principle that 30% of any profits from an EPF investment would be returned through TJJR Diversified “as long as it was transparent and above board”.

What Manikis was unaware of at the time (until being informed by Sarawak Report) was that Ladylaw Project Coordinator, Azlan Shah Md Radzi, was also a director of TJJR Diversified:

Limage Holdings S.A.

The 2015 project to invest in ‘Integrated Medical Cities’ appears to have followed a different model to Ladylaw’s property investment proposals, whilst involving many of the same operatives and, once again, the transfer of astonishing sums of money to a little known foreign company.

Documents suggest EPF’s ‘Jaffar bin Raihan’ engaged TJJR Diversified (M) which in turn employed as its ‘foreign investment partner’ Limage Holdings SA, based in Luxembourg.

Limage Holdings is a financial investment company, owned by a single Hungarian national, resident in the United States, called Gyorgy Matrai. In 2005 Matrai was arrested in Switzerland and detained for two years, under investigation for money laundering, fraud and forgery.

In 2006 a court order was made to the United States for informaton on their resident’s bank accounts and Matrai was eventually found guilty and sentenced to two years’ imprisonment (already served pre-trial) and millions of dollars in fines. In 2014 the Swiss courts rejected an appeal by Matrai against his conviction.

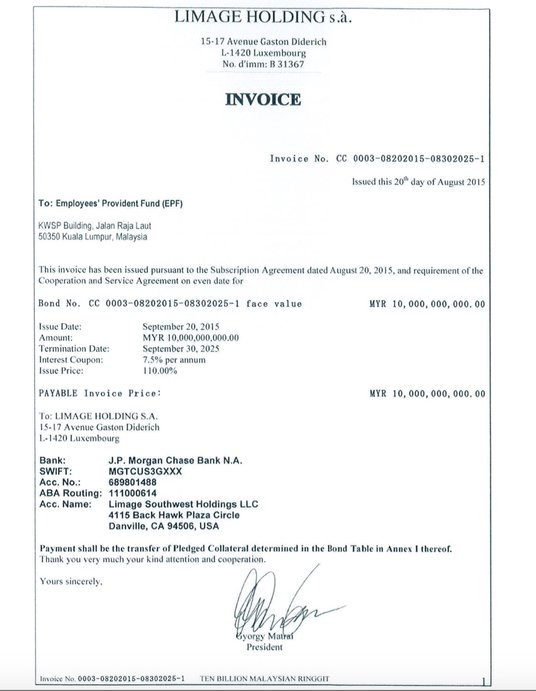

Undeterred, documents show that EPF and TJJR Diversified entered into a ‘Cooperation and Service Agreement’ with Limage Holdings S.A. on August 20th 2015 to manage a staggering sum of RM10 billion, supposedly to fund the medical cities project.

EPF has now stated that papers have been forged and so far Gyorgy Matrai has not responded to emails from journalists. Nevertheless, according to extensive further documentation, TJJR agreed to enter into a ‘Revolving Financing Agreement’ with Limage to fund ‘various Scientific, Cultural and Humanitarian Development Projects’ under the Kyoto Protocol over a five year period involving “capital assets.. totalling USD7 Billion“.

The priority was stated as being “part of the development of the Integrated Medical City and related infrastructure developments”.

The role of Limage Holdings is described as being “able and agreeable to obtain financing facilities” and “to prepare the necessary and required paperwork for TJJR .. to be the beneficiary of the required revolving L/Cs [Letters of Credit]. Funding to be arranged by Limage to be the Lender”.

Development of a deal

This agreement between TJJR and Limage can be seen to have evolved out of an correspondence just two days earlier, 18th June 2015, when a purported EPF executive named ‘Jaffar bin Raihan’ employed a private gmail address – [email protected] – to contact Gyorgy Matrai at his known email address.

The email invited Matrai’s ‘expertise’ and ‘support’ regarding an investment programme, using as collateral RM10.64 billion worth of EPF bonds with the stock codes VZ120003/22/23/24/21 and PX140020 and DZ012851.

These, bonds had been “assigned in the name of TJJR Diversified” in order to “financially enhance the funding possibility of the Humanitarian project which is being taken up in Malaysia”, according to the email.

The purported EPF executive explained that TJJR, as the designated ‘Project Coordinators’ were now the ‘legal assignees’ of these bonds and ‘awarded the rights to utilise these bonds for attaining funding for the development of the project’.

Matrai had replied positively the same day to say he was eager to be involved, but that it would be better to describe the enterprise not as an “investment” but as “a leveraged financial transaction”, in order to avoid giving the impression the product was being offered to brokers. At the same time he requested more information on the humanitarian projects EPF wished to fund, thereby indicating a total ignorance of the grand hospital programme that had been devised as the reason for EPF’s investment.

Promoting his company’s services, Matrai went on to claim that as a Luxembourg company, Limage Holdings was authorised by regulators to leverage up to ten times any investment deposited with it. He told the purported EPF executive:

“We are going to utilize your bonds as capital on cash value we are able to obtain funding against them, and leverage that cash value to finance the projects you designate..”

In accordance with the agreement of August 20th, Matrai, through Limage, invoiced EPF for a RM10 billion bond payable to the JP Morgan account of an affiliate company, also owned by him, Limage Southwest Holdings in Danville, California.

The invoice stated that the payment would be met by Pledged Collateral as determined by the EPF Bond table, which was annexed. This confirms that no less than RM10.64 billion worth of bond notes owned by EPF in various Malaysian stocks, including the PLUS highway project and Tanjung Energy were passed over to Limage/TJJR.

A further letter of indemnity from EPF exonerated Limage and fraudster Dr Gyorgy Matrai from any possible charges of wrong-doing in the context of the agreement.

The letter was stamped with a seal and notarised by the KL based notary Wong Kien Cheong and signed in his presence by one ‘Jaffar bin Raihan’, who presented the identity card number belonging to EPF executive Ja’afar bin Rihan.

The assumption is, therefore, that the EPF executive did indeed sign off the indemnity, as checked by the notary against the ID card presented. However, Ja’afar bin Rihan has said that he is the victim of forged documents and therefore of an extremely elaborate hoax for reasons that so far remain unexplained, despite the matter having been reported to the police.

USD2.4 billion Raised Through HSBC ?

Further documents viewed by Sarawak Report indicate that several months later, on 22nd June 2016, the bank, acting on behalf of its client TJJR Diversified (M) Sdn Bhd, issued a transfer notice for US$2.4 billion to Matrai’s Limage Southwest Holdings LLC account in California, citing it as payment of the invoice issued by the company for RM10 billion.

HSBC have denied the documents are genuine, although they form part of a legal case lodged by a third party seeking compensation *(see note)

According to these contested documents, the EPF bonds were the collateral for the money, according to the Hong Kong based HSBC officer, Penny C L Tsang, who allegedly quoted the same invoice number – Invoice No. CC 0003-08202015-08302025-1 – as the one quoted by Limage in August 2015 (see invoice above).

“We are acting on behalf of our client TJJR Diversified (M) Sdn Bhd. Further to a memorandum of understanding with the trustee agreement which is managed by HSBC Hong Kong, HSBC Cyerjaya Malaysia and HSBC Labuan to facilitate the Management of Assets to Blocked the EPF Bonds as well as fund management. All referred and relevant documents are attached herein.

This letter is to notify you of this bank’s intent to issue upon instruction a SWIFT MT 760 with a face value in the amount of Two Thousand Four Hundred Million US Dollars (2,400,000,000.00) for the exclusive use and benefit of Limage Southwest holdings LLC as payment of the attached Invoice No. CC 0003-08202015-08302025-1 …….

Moving such sums involves a great deal of regulatory procedure, however, and only in September 2016 was the transfer to the United States ready to proceed, according to further apparent documents viewed by Sarawak Report.

Leveraging US$4 Billion To Return To Malaysia?

In the meantime, further evidence shows that TJJR Diversified (M) was making arrangements for the transfer back of a leveraged cash amount into Malaysia.

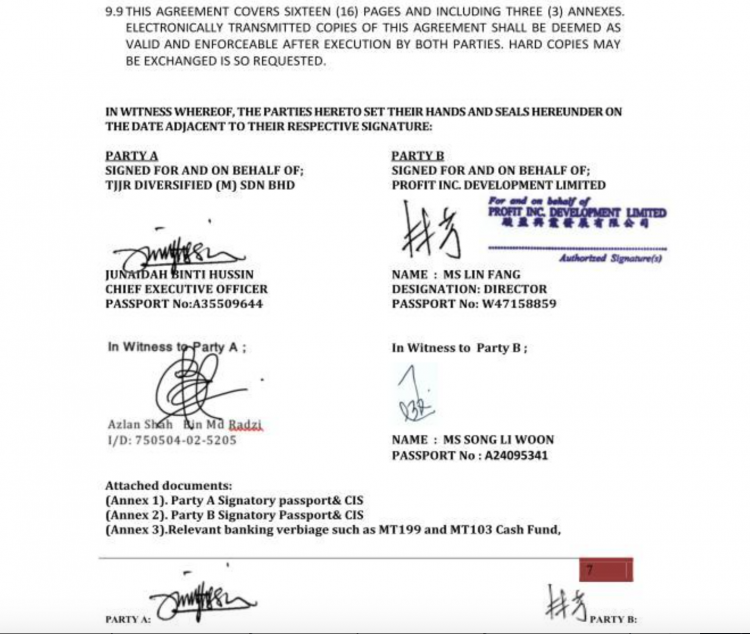

In February 2016 the company entered into a private ‘strategic partnership agreement’ with a company in Hong Kong named Profit Inc. Development Limited, whose major shareholder is a 36 year old Chinese national named Ms Lin Fang.

The purpose of the agreement was for Profit Inc. Development to assist in the transfer of a staggering USD$4 billion from Limage Southwest Holdings in California back into Hong Kong for the stated purpose of engaging in various ‘investments’.

However, the terms of the agreement provided merely that once Profit Inc. Development received the enormous sum it would divide it the cash between the two parties, retaining a massive 20% cut for Ms Lin Fang’s enterprise.

The US$4 billion appears clearly connected to the original arrangement with Limage to raise cash for TJJR from the US$2.4 billion raised from the EPF bonds. The two parties drew up detailed draft banking documents signed by Junaidah Hussin and Lin Fang to cement the deal.

US$4 Billion Transfer Problems!

However, as 2016 came and went it appears there were problems organising the transfer via the Hong Kong company. US$4 billion is an enormous sum to get banks to agree to move without cast iron guarantees and Central Bank approvals. Such sums can affect currencies and stock markets.

By February 24th 2017, therefore, it would appear TJJR Diversified was entering into a new arrangement, this time with a Malaysian company named MJR Global Services Sdn Bhd, also with a view to transferring what seems to have been the same $4 billion from Limage Southwest Holdings LLC in the United States.

MJR Global Services had been incorporated just weeks before the approach from TJJR Diversified (M), in November 2016, and its sole proprietor was a 21 year old Malaysian named Mohammad Junaidi bin Abdullah. Yet this was the entity TJJR engaged to assist in organising an RHB current multi-currency account in Petaling Jaya to receive a SWIFT transfer from Limage Southwest Holdings for the US$4 billion raised on the EPF bonds.

Mohammad Junaidi was to be paid RM100,000 for his pains on the date the account was opened and then a staggering commission of 25% of the US$4 billion “payable immediately after the fund clearance from the Malaysian Government and Malaysia Central Bank”!

Gyorgy Matrai Invited To Discussions At RHB Bank

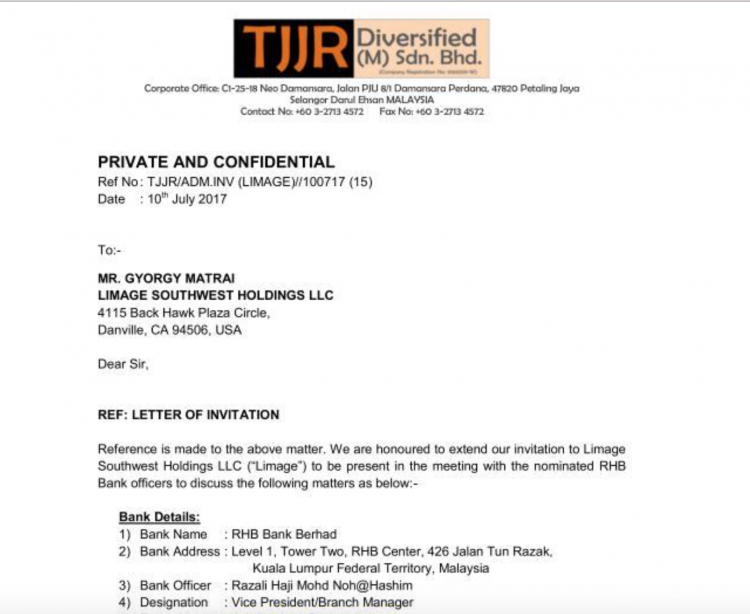

This strategy for returning the EPF money also appears to have been abandoned, because by July 2017 TJJR’s CEO/Managing Director, Azlan Shah Md Radzi, had begun organising direct negotiations between fraudster, Dr Gyorgy Matrai of Limage and RHB bank, where TJJR Diversified (M) Sdn Bhd seems to have finally opened a series of accounts at the RHB Tower office in KL.

The negotiations between Matrai, TJJR and RHB executives, including a Vice President and Branch Manager named Razali Haji Mohd Noh Hashim and a Senior Vice President Khir Badrul Bin Mohamad Shaharudin, were to discuss what was now being openly described to the bank as funding for the “Development of the EPF/KWSP Integrated Medical Cities Project in Malaysia”.

Azlan Shah Radzi wrote to Khir Badrul Mohamad on August 29th 2017:

“We are pleased to inform you that RHB Bank has been officially nominated as the banker on behalf of the Limage Southwest Holdings LLC and JP Morgan Chase Bank NA to undertake the project monitoring and progress payments. This is to inform you that the project funding arrangement is currently in place”

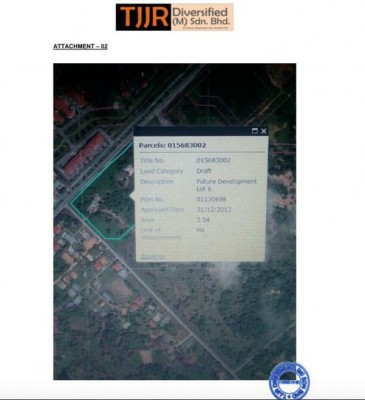

On the same day Azlan Shah Md Radzi informed the bank that three plots in KK Sabah had been negotiated as being available to launch the start of the project. In a document described as “Verification of Land Site” the sites registered under title numbers 015683002/2989/3998 are shown totalling 18 hectares.

Research in the land registry shows that these plots are currently still under the ownership of the Sabah Housing Department, which has taken out a RM25 million charge on the land, with none other than RHB Bank itself.

Documents indicate that the bank was passed the details of the hospital project supposedly supported by EPF and the Ministry of Health, presumably to provide justification for plans to transfer over a billion dollars from Limage Southwest Holdings in California into the new TJJR Diversified account.

Officials at the bank appear not to have queried why the project, involving a planned RM48 billion of EPF investment in collaboration with the Ministry of Health, had yet to be publicly announced.

Sources have told Sarawak Report that the real purpose for bringing the cash back into Malaysia was to fund BN’s election hand-outs and that by late 2017 the transfer was becoming urgent as delays continued.

It is probable that these delays would have owed to further due diligence questions by the bank, for example on the detail of the project, given the increasingly tight strictures on banks concerning large payments of this kind.

For example, the bank would have been expected to enquire who had been engaged to build the hospital complex, given the vast sum of money being imported?

It is certainly notable that in September 2017, a full two years after the RM10.64 billion worth of bonds were allegedly assigned as collateral by EPF for this alleged medical cities project, a new player was introduced in the form of the construction company, purportedly hired for the job.

Panama Based Construction Company

The construction company with the strangely translated name of Diver Module Sdn Bhd had only been incorporated in Malaysia a month before, on 17th August 2017.

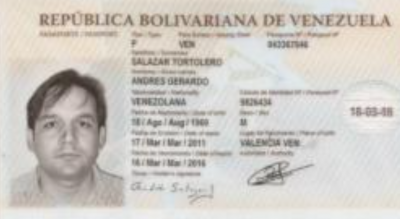

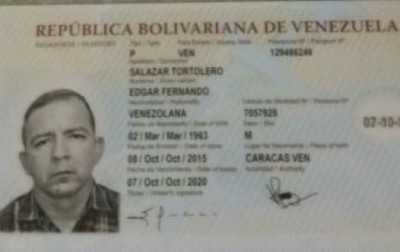

It is owned by a group of Venezuelan brothers, named Salazar Tortolero, as a subsdiary of their company in Panama with the Spanish name of Grupo Diversica S.A.

The Panama company’s Facebook page indicates a fairly modest-sized company, mainly specialising in residential property building and renovation. However, following a payment of US$180,000 to the Diver Module Sdn Bhd bank account in KL on October 18th, an elaborate presentation appears to have been made available, detailing the extent of the capability and expertise of the company to act as the construction group for the Medical Cities Project.

The power point presentation drawn up by Diver Module Sdn Bnd indicates access to an international team of Panamanian, Spanish and Venezuelan experts in the field of building hospitals and cites, as well as major construction partners, including for example the British giant construction firm Bovis.

Sarawak Report has no evidence to suggest that any of the claims made by Diver Module are not entirely correct. However, we question why such an enormous Malaysian project appears to have been handed without tender or any public announcement to an otherwise largely unheard of Venezuelan-owned construction group, based in the notorious off-shore haven of Panama, especially given this multi-billion dollar enterprise was allegedly bankrolled by EPF in an alleged coordinated venture with the Ministry of Health?

EPF has now stated that the project is a fraud and that its executives are not involved.

However, sources have informed Sarawak Report that finally, in January of 2018, a sum of US$1.6 billion was indeed transferred back into TJJR’s Malaysian account at RHB bank via JP Morgan, which holds the Limage Southwest Holdings Account in California.

The sources claim that, as with the funds from 1MDB (which arrived back in Malaysia just weeks before the calling of GE13) the purpose has been to provide BN’s leader with a new GE14 billion dollar election account to hand out cash to voters…. courtesy, it would appear, of their own stolen savings!

* HSBC have subsequently investigated this matter and they have informed Sarawak Report April 4th 2018 that they do not consider these documents to be genuine.