A growing slew of corruption accusations has beset the British Conservative Party under Boris Johnson, relating first to so-called ‘Cash for Access’, then ‘Cash for Honours’ and finally ‘Cash for Peerages’, namely the granting of seats in the House of Lords to party donors.

Now, Sarawak Report has probed into further concerns that foreign funding and foreign influences may have inevitably infiltrated this corrupted process, given the known ties of certain donors who have been ennobled.

In one instance an individual connected to 1MDB and associated sovereign wealth funds in the Middle East, Aamer Sarfraz, was recently ennobled through the alleged deal to promote party vice treasurers who raise sufficient funds …. to be rapidly appointed co-chairman of the All Party Parliamentary Group [APPG] on Sovereign Wealth Funds and vice-chairman of the APPGs on both Saudi Arabia and Oman, as well as Burma at the impressively young age of 38.

£3 Million Price Tag Per Peerage

The revelations in a shocking report in last week’s Sunday Times detailed how life peerages have been accorded a price tag by conservative party managers, whereby prospective donors are appointed to the list of party treasurers with a view to them raising at least £3 million pounds, the sum known to guarantee a subsequent lordship sponsored by the party.

Lord Sarfraz was a party treasurer from 2018 – 2019, at which point he was granted a peerage. According to the Sunday Times:

“wealthy benefactors appear to be guaranteed a peerage if they take on the temporary role as the party treasurer and increase their own donations beyond £3 million. In the past two decades, all 16 of the party’s main treasurers — apart from the most recent, who stood down two months ago having donated £3.8 million — have been offered a seat in the Lords.” [Sunday Times]

This revelation has come in the wake of a recent widely condemned personal intervention by Boris Johnson to overturn a decision by the Honours Committee to reject a peerage for the previously disgraced party treasurer Peter Cruddas (who had been caught up in an earlier ‘cash for access’ scandal).

Following the award of his peerage last December, thanks to Johnson’s intervention, it was revealed that Cruddas donated a further £500,000 to the Conservative Party. The scandal has deepened as the Johnson government last week sought and failed to abolish the office of the independent Standards Commissioner, who had punished a conservative MP for lobbying on behalf of clients, and to replace it with a body the Conservatives could control.

The Youthful Lord Sarfraz

The row raises crucial questions, according to our research, about other recent appointments including that of Lord Sarfraz who was granted a life peerage in September 2020 at the astonishingly young age of 38 (making him the 3rd youngest peer in the UK) after being nominated by Boris Johnson in his 2019 Dissolution Honours List.

Aarmer Sarfraz is said by colleagues to have only joined the party some two years prior to becoming a Lord, during which he played the role of treasurer, in the manner described by the Sunday Times.

The new lord boasts in his Wikipedia page that he remained a treasurer through the period of the last election apparently contributing to the party’s ‘historic win’, after which he resigned the role on receiving his peerage.

However, by contrast with other honours recipients following this route, the young Lord has only officially donated a slender £122,500 to the Conservative party, in the period just from 2018.

Under the circumstances it prompts the question what therefore recommended Sarfraz for this influential honour at such a very young age if he did not contribute more than a relatively small amount compared to the others ennobled through this system of treasurers to the party and had barely spent two years supporting the Conservative cause?

It seems unlikely to have been his service to British public life. Sarawak Report notes that the same Wikipedia page and Sarfraz’s own online presence is extremely sparse by comparison with most prominent people who have gained the sort of recognition that would recommend a peerage.

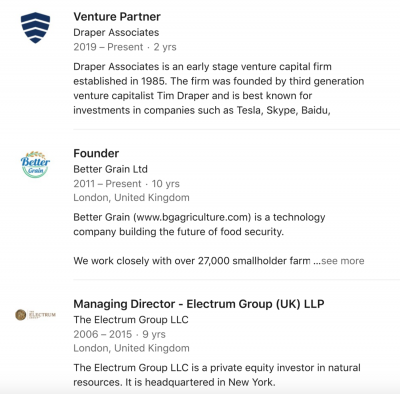

There is very little recorded in the way of life achievements or other activities of note, certainly to do with Britain. His business career outlines a path tied closely to the job he got shortly after leaving the LSE when he became employed in 2006 by the investment advisor, Electrum Group, based in the United States.

Electrum is founded and run by the American Israeli-connected billionaire Thomas Kaplan, who speculates in metal resources and has adopted a highly political stance in the Middle East having set up a number of campaign groups that support the coalition of Israel, UAE and Saudi Arabia against Iran and its allies in the region.

His ties to the UAE and the Abu Dhabi Crown Prince are so close that in one article for a local newspaper Kaplan described the Emirates and its leaders as the:

“closest partners in more facets of my life than anyone else other than my wife”.

It was Sarawak Report that revealed that one of the key investors in Electrum Group was Jho Low, who sunk $150 million of stolen cash from 1MDB fund into the project. The other major investors were the Abu Dhabi sovereign wealth fund Mubadala and the Kuwait Investment Authority.

Kaplan also has a close association with the longstanding Tony Blair aide, Jonathan Powell, who later acted as an advisor to Tony Blair Associates (TBA), the advisory business run by the former prime minister then Special Envoy to the Middle East. TBA has also worked closely with Mubadala.

Apart from his career working for Kaplan (as Managing Director of Electrum UK till 2015) there is little in Lord Sarfraz’s CV that would indicate any significant contribution to British public life or public debate, save for an article recently published in Foreign Policy magazine from his new position in the House of Lords.

The September article, entitled “De-radicalising Western Foreign Policy” criticises what it describes as ‘Radical pan-Arabism and radical Islamism’ in the Middle East as well has what he calls endless misconstrued and failed efforts to establish “radical Westernism”, namely “western-style liberal democracy” in the region.

Presumably this reflects his political stance and focus in the House of Lords and as the newly appointed Chair of the All Party Sovereign Wealth Fund Group, in that he would like to see a change of emphasis in Britain’s handling of the Middle East – away from human rights and democracy issues, which he explains are not ‘cultural’ to the region.

In which case it also reflects the over-all message of the family-run regimes such as Saudi Arabia, the UAE and Kuwait which have funded so much of Thomas Kaplan’s global investments through, for example, Sarfraz’s own former employer the Electrum Group.

In tandem with such sensitive pro-Saudi views in the wake of the Khashoggi murder and Yemen war, several conservative sources have described the appointment as baffling given Sarfraz’s youth and inexperience. He has been described as a weak performer when it comes to speeches and has personally donated far less than others to the party.

The matter has led to speculation that Sarfraz has been successful in raising funds or mobilising influence from others, if not directly from himself. SR has learnt that, in line with the alleged targets for the Vice Treasurer role, there is an understanding in Tory circles that Sarfraz indeed achieved major contributions through his fundraising efforts, although these are not identified as direct personal donations.

This raises the question as to whom he would have turned to raise such sums which appear to have resulted in such an elevation and position of influence for himself?

Eco-Profile – A Global Do Gooder?

There is one segment of Lord Sarfraz’s official profile that might appear to separate him from Kaplan’s business and interest orbit as an independent entrepreneur.

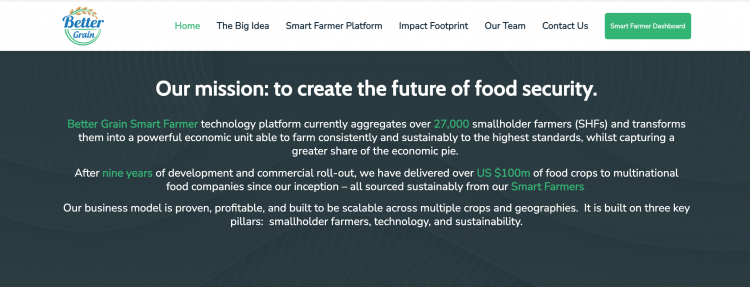

After leaving his role at Electrum in 2015, Sarfraz indicates he focused on his business Better Grain Ltd, which he says he founded in 2011 and which continues till this day.

The company is designed, according to its extensive website, to enable tens of thousands of small holder farmers in his native Pakistan and other emerging countries to reach the market place.

Better Grain claims to work closely with 27,000 such farmers and to have delivered over £100 million of “sustainably sourced food crops” to multi-national companies since its inception.

In his profile in the House of Lords Sarfraz likewise details his business role as “the founder of Better Grain, an agricultural technology business” that “works with tens of thousands of smallholder farmers in Asia and uses technology to increase yields and incomes, while reducing emissions and water usage”.

In fact, Better Grain itself, whilst headquartered in Britain with an extensive website, has been little more than a recent shop window for Sarfraz. According to UK Companies House records, Better Grain Limited was incorporated in 2016 and kept as a dormant holding company before being dissolved in October 2019, just before the election.

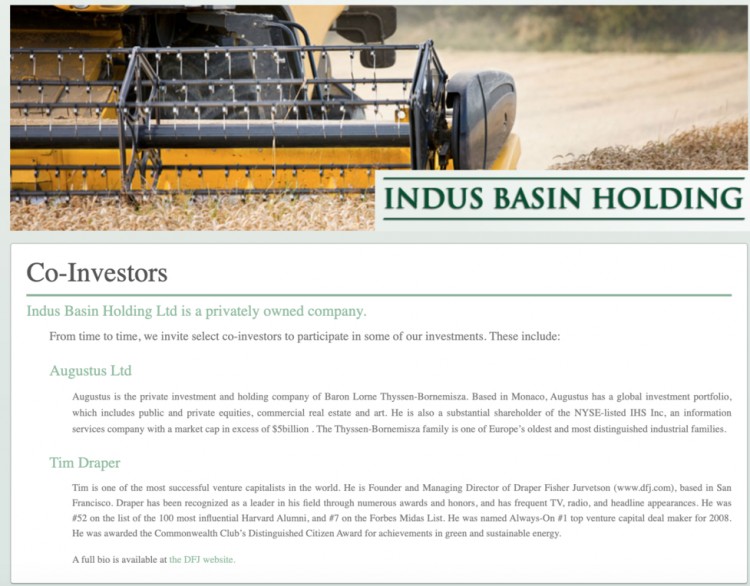

Its directors, on the other hand, indicate Sarfraz’s close continuing links with Thomas Kaplan’s network. Aside from Sarfraz they included Thomas Kaplan’s key manager, Ali Reza Erfan, as well as Hamid Jourabchi, known as the right-hand man of Kaplan’s close friend and business partner the billionaire Lorne Thyssen-Bornemisza.

Lorne Thyssen-Bornemisza has meanwhile invested in a business in Pakistan founded by Sarfraz in 2012, which he has not included in his UK House of Lords profile, namely the Mauritius incorporated Indus Basin Holding.

Another director of the now defunct Better Grain Ltd, Varun Chandra, was from the same circle although more associated with the Labour Party. Chandra previously worked for Tony Blair Associates and negotiated a $65,000 a month fee for the former prime minister (whilst he was Middle East envoy) to act as a consultant for PetroSaudi – money that once again turned out to have been stolen from 1MDB.

Kaplan’s own connections to Tony Blair’s circle are well known having forged a close friendship at Oxford University with Jonathan Powell.

A separate company Better Grain UK was set up in June 2019 that appeared to dispense with these associations just as Sarfraz was preparing to enter into the House of Lords. This company is directed and owned only by himself and also operates as a dormant company.

Indeed the UK headquarters address on the extensive Better Grain website – 96 Kensington High Street – is no more than a meeting facility, which offers six floors of “design-led hot-desk lounges, pods, private offices, one man offices and penthouse office suites” along with the usual mail box and message taking services.

Indus Basin Holding

Research by Sarawak Report indicates that Better Grain bases its public profile on Sarfraz’s business and established family interests back in Pakistan where his father is an influential retired Admiral with high connections in the government and the country’s powerful military establishment.

These have been gathered under the Mauritius registered Indus Basin Holding set up by Sarfraz in 2012, which is focused on acquiring investments particularly in the distribution of the massive cultivation of rice in the threatened Indus Delta region. Once again the connections to his then employer, Thomas Kaplan, have been identified.

An Intelligence Online article published 2019 entitled “Thomas Kaplan, the billionaire pushing Abu Dhabi’s interests in the Middle East” states:

“Lorne Thyssen, together with Thomas Kaplan, sought out agricultural projects in Pakistan in the late 2000s through his Monaco family office, Augustus Management, which is managed by his right- hand man, former Crédit Suisse marketing director Hamid Jourabchi. Thyssen invested in Indus Basin Holding (IBH), a fund that specialises in Southeast Asian agricultural projects, and then in Better Grain. These companies were set up by Aamer A. Sarfraz and Ali Reza Erfan, both Kaplan’s business partners within the Electrum Group.” [Intelligence Online, 2019]

Although Lord Sarfraz makes no mention of his association with Indus Basin Holding in his UK profiles, Tony Blair’s political ally David Miliband has acted as a consultant to Indus Basin Holding.

The other major original investor in Indus Basin Holding (IBH) was another billionaire American entrepreneur, Tim Draper. Lord Sarfraz’s latest position on his CV is stated to being as Venture Partner in Draper Associates, appointed 2019.

The prime acquisition of IBH was in a major existing Pakistani concern named Rice Partners which now brands its activities together with Better Grain and claims to produce ‘sustainable rice’.

Rice Partners states a close association with the Uncle Ben rice brand owned by the Mars food company and Indus Basin Holdings has cited USAID as a ‘partner’ along with Mars and other companies.

Although the Indus Basin Holding website is no longer available online (as of last year) Sarawak Report has viewed its older postings. Should anyone be in doubt as to how embedded this venture funded enterprise is in the Pakistani establishment, the stated key team members in IBH include several influential local figures, for example, Rao Ahmed Raza in charge of Government Relations. He is described as a retired Director of the Intelligence Bureau with “vast experience in interrogation and investigation, and of field work as a team leader in the areas of security planning, administration, coordination with government”.

Another director is Brigadier Farooq Afzal, stated to be responsible for the day-to-day operational oversight of IBH’s businesses. According to the IBH site “In his 31-year military career, Brigadier Afzal served in numerous roles, including as Pakistan’s Defence Attache in Afghanistan”.

Furthermore, Indus Basin Holdings (set up when Aamer Sarfraz was in his twenties) plainly states its close connections to the Fazaldad Institute, which is the philanthropy arm of Aamer’s wealthy and influential father Naeem Sarfraz, a former admiral and then shipping entrepreneur who boasts numerous roles in Pakistani public life, including leading on a government backed initiative to develop the waterways of the Indus basin.

The foundation states its focus on human rights and education to “counter extremism and terrorism.

FHRI’s [Fazaldad Human Rights Institute] effort towards spreading moderation and tolerance along with human rights has been acclaimed as a unique and effective tool to counter extremism and terrorism in the Muslim world.

These predominantly Middle Eastern and Pakistani preoccupations and objectives, connected as they are to high level politics and figures from abroad, plus foreign entrepreneurship, networking and resource competition, once more raises the question as to why Lord Sarfraz has been elevated to a lifelong position in British political life at such a young age?

Better Grain claims major human and environmental achievements, most of which seem entwined in the CSR efforts of Rice Partners run by Mars Foods, frequently in tandem with the Pakistani Government. The Sarfraz family have plainly combined these laudable efforts with personal entrepreneurship and their political aspirations.

More to the point, given the present Cash for Lordships scandal, the Sarfraz family’s primary political interests appear to be embedded in their entrepreneurship together with their associates in the Middle East and Pakistan – a platform that Lord Sarfraz is now promoting in the UK Parliament to the further benefit of his core business contacts and investors, such as Thomas Kaplan and connected sovereign wealth funds.

How Sarfraz was therefore recommended for a Lordship and if he indeed channelled over £2 million into the party during his position as vice treasurer, as indicated by sources and by the Sunday Times investigation is relevant, given British life peers are expected to view the world from the perspective of what benefits Britain and its values, which Lord Sarfraz has so recently dismissed as “Western Radicalism” in the context of the Middle East.

So far, according to the Sunday Times, Sarfraz has failed to answer repeated enquiries as to how he obtained his Lordship and whether, and if so from where, he has channelled donations having donated £125,000 from his personal funds?

Lord Sarfraz has equally declined to answer Sarawak Report’s request for him to comment on whether his ennoblement was connected to foreign influence or foreign funding.

Honourable Members For The Middle East?

Lord Sarfraz is not the only Kaplan connected politician to have got caught up in the present debate on standards and access capitalism in the Conservative Party. The leading Brexiteer, Daniel Kawczynski, has also acknowledged he is on a retainer of £6,000 a month as an advisor to Electrum – the accumulated total of his earnings is £280,000 so far, according to a party source.

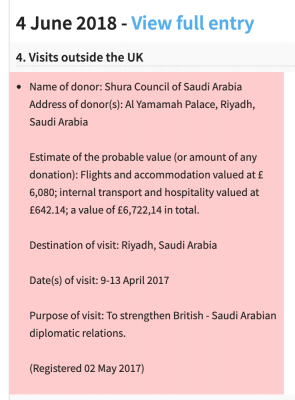

Kawczynski who is of Polish heritage and heads the All Party Parliamentary Group on Poland has repeatedly revealed an extensive interest in the Middle East where he has travelled as a guest of the Saudi Foreign Ministry.

He has intervened to support Saudi Arabia against sanctions by the UK government in the wake of the Jamal Kasshoggi murder and over the war on Yemen, saying in one interview:

“I have been battling against extraordinary ignorance and prejudice against Saudi Arabia for many years, and that includes ignorance and prejudice from British MPs.”

So enthusiastic is his support for the ‘misunderstood’ desert Kingdom that he has been dubbed as the Honourable Member for Saudi Arabia by one newspaper. He has been referred to the Standards Commissioner for matters such as attacking the Saudi political enemy Qatar at a conference, having been paid £15,000 by Qatar’s pro-Saudi opposition group. His register of interests declares numerous visits to Saudi Arabia paid by the Foreign Ministry.

Sources in the Conservative party have told Sarawak Report that Kawczynski has been building on his Middle East contacts assiduously in recent months and years with a professed ambition to make it to the position of Foreign Secretary by the next election.