The spiralling scandal of Malaysia’s Littoral Combat Ship procurement disaster has begun to reach the European nations whose companies have emerged as pivotal players in the long overdue RM9 billion contract that has yet to produce a single boat.

Germany’s Der Speigal magazine published a damning review this weekend based on the documents that have now emerged which highlight the role of that country’s major arms manufacturer, Rheinmetall, in the loss of at least a billion ringgit that seems to have gone completely missing.

Also missing is the company’s Asia head, an Australian national named Gordon Hargreave, who wiped his LinkedIn presence last week after being identified by Sarawak Report and has failed to answer questions or make a statement since the facts came out.

Nonetheless, according to Der Speigal, the company’s chief executive, Armin Papperger, came out “angry” and fighting when confronted by the negative comments made in a Malaysian forensic audit report commissioned by the contract holder Boustead in 2018.

As the magazine summarised, the auditor’s report commissioned by Boustead (the Malaysian company commissioned by the Government to build the boats) claimed:

In a mix of mismanagement and bogus deals, nearly a billion ringgit disappeared from [the Rheinmetall subsidiary] Contraves in Malacca, headed by Australian Gordon Hargreave, a long-time Rheinmetall employee, and other Boustead business partners. Contraves delivered too little material – and also defective, the report goes on to say. To this day, parts of the equipment sit unused in warehouses. [translation]

Faced with these allegations from the report, which was just last week de-classified and released by ministers in Malaysia, Papperger had nothing but denials to offer and promptly went on the war-path, first against the auditors and then against Boustead itself.

This is how Der Speigal reported what he had to say:

At Rheinmetall, they are angry about these allegations. The suspicion that the construct around Contraves served to cover up the misappropriation of state funds is “rejected as unfounded” by the company.

The contract structure with far-reaching powers for Hargreave is completely customary internationally, he and his colleague were appointed by the equally staffed board of directors. The »bank mandate« is also subject to approval by this supervisory board.

For more than 35 years, Contraves has had expertise in such orders and otherwise delivered everything as ordered. The equipment supplied was “particularly valuable,” some of which was not installed because the shipyard work was “not advanced enough.”

Contraves also did not place any orders without consideration. Apparently, Rheinmetall sees the report as little more than a government commissioned report, after all, Contraves was never asked “to provide information for the report commissioned by Boustead.”

An independent auditor accompanied Contraves at all times, and Boustead himself signed off on the balance sheets. Allegations against Hargreaves’ successor at Contraves [apparently his former secretary] who was arrested in early 2022, are said to have proved unfounded. She herself did not respond to SPIEGEL’s questions.

The people of Düsseldorf [Rheinmetall] see themselves as a scapegoat and the roles in the economic crime thriller are distributed the other way around: while Contraves has fulfilled its obligations, the Boustead subsidiary BNS, which is responsible for building the ships – and ultimately the Malaysian state – still owes the Germans several million euros.

At the company’s headquarters in Düsseldorf, thoughts are circling about getting the money by taking legal action. The deliveries from Contraves resulted in “financial claims that have not yet been settled”. The company is therefore considering “enforcing these claims with legal means against BNS,” Rheinmetall told SPIEGEL.

In addition, allegations by Malaysian politicians that Hargreave fled with embezzled millions are far-fetched – the man is still employed at Rheinmetall, only now as a member of the Board of Directors at Contraves.

There is no reason to suspect that he embezzled money, otherwise investigations would have been initiated.

The fact that Hargreave, who leaves questions unanswered, recently deleted his LinkedIn profile is apparently unsuspicious at Rheinmetall.” Perhaps the Australian is simply concerned about getting lost in the mudslinging that is currently raging in Malaysian politics. [Translated – full article]

It is a pretty shocking turn of events that could face the Malaysian state owned company and subsidiary of the Armed Forces Pension Fund with further legal and financial headaches after this collapse of the country’s largest ever defence contract (another brainchild of the recently imprisoned ex-PM Najib).

However, as Der Speigal points out “Rheinmetall’s Malaysia problem is extraordinarily bizarre, even in the armaments industry. And the case raises the question of why the group hasn’t withdrawn from the country long ago.”

After all, if the German manufacturer had issues with its Boustead (BNS) contract why is this outburst the first anyone has heard about it with no legal moves having been made during the entire 12 years since it signed its contract with the Malaysian project and only after a slew of unfavourable allegations have come to light?

The angry protests do not emanate either from a company with an unblemished record. Quite the contrary.

In the early 2000’s Rheinmetall had to pay a fine of €37 million and return illegal profits over bribes paid in Greece for the sale of the Asrad air defense system. In 2012 it was banned in India from arms orders for ten years because of alleged corrupt practices (which Rheinmetall denies).

In 2018 the company was criticised for continuing to supply ammunition to Saudi Arabia despite an export ban imposed by the federal government, by using a handy detour via Italy and South Africa.

So, what are the specific allegations made about Rheinmetall’s role in the Malaysian LCS contract and what do they tell Malaysians about how its political masters from UMNO and their appointees at the time served their country in managing this project?

Devastating Findings By Boustead Auditors in 2018

The allegations which Rheinmetall say are so unfair are as follows. That for no very good reason, especially given the company has no expertise in boat construction, it was decided to engage a Malaysia based subsidiary of Rheinmetall named Contraves Advanced Devices Sdn Bhd (CAD) as a procurement middleman for products that would largely be purchased from the chosen French boat designer DCNS (another story of alleged corruption to be visited shortly).

In a modus operandi strikingly reminiscent of the 1MDB joint venture with the bogus front company PetroSaudi the previous year, Boustead Naval Shipyards was deployed to buy into Contraves in 2010, paying RM25 million for a 51% stake.

According to Contraves’ announcements at the time, its then CEO, one Gordon Hargreave, was credited as the man who “implemented” the deal and who took “operational control” of the new joint venture. This was despite Contraves now being the minority 49% shareholder and Boustead being the recipient of the actual contract as well as the one paying the money:

Rheinmetall’s boss has described this as a ‘customary arrangement’. However, the auditors from IFA Malaysia brought in by Boustead Heavy Industries clearly didn’t think so. In fact, their report zeroes heavily into the defects of what it plainly sees as a highly anomalous arrangement as one of the key problems with the entire project.

The structure signed up to by Boustead bosses (headed by Najib’s right hand man Lodin Wok Kamaruddin, Chairman of the Board) had left what should have been the commanding partner in the subsidiary with practically no influence at all over what went on. With Hargreave in charge Boustead was also cut off from information about the subsidiary’s accounts and all the financial management.

In the event, some RM3.3 billion of the entire RM9 billion invested went through this procurement subsidiary, of which the auditors said about a billion cannot be accounted for at all – it simply went missing, much as Mr Hargreave now appears to have done himself.

Perhaps most damning of all, the auditors complained that they had repeatedly requested of Contraves and of Rheinmetall a proper set of all the accounts relating to these procurement activities, which had never been made available to the plainly negligent managers and boards of Boustead, but were met with a blank response from the German company.

So much, in that case, for the claims by Rheinmetall never to have been included in this enquiry process, and so much also for the claims that this was somehow a normal and acceptable business arrangement. It was pushed through by the Boustead board says the auditor, despite the expressed misgivings of the ex-Chief of the Navy himself:

We noted 12 LOAs [Letters of Award/Contracts] worth RM3.3 billion were issued to CAD/CED, which was approximately 37% of the total contract value of RM9billion. During our review of the BOD minutes, it was noted that the Ex-Chief of the Navy had expressed his concerns about over-reliance on CAD/CED for [the] LCS Programme. He also advised the company to take the necessary precautions to minimise such an exposure by having the involvement of others. However, no corrective actions were taken and the matter never raised again.

observe the auditors.

As Malaysians who have followed the unravelling of this saga over the past couple of weeks will know, CED (Contraves Electrodynamics Sdn Bhd) was a second middleman subsidiary set up by Contraves (CAD) to further ‘layer’ (as the anti-money laundering term goes) the transactions through another party in order to further diminish the transparency of the figures. The auditors could see no other useful purpose for the company.

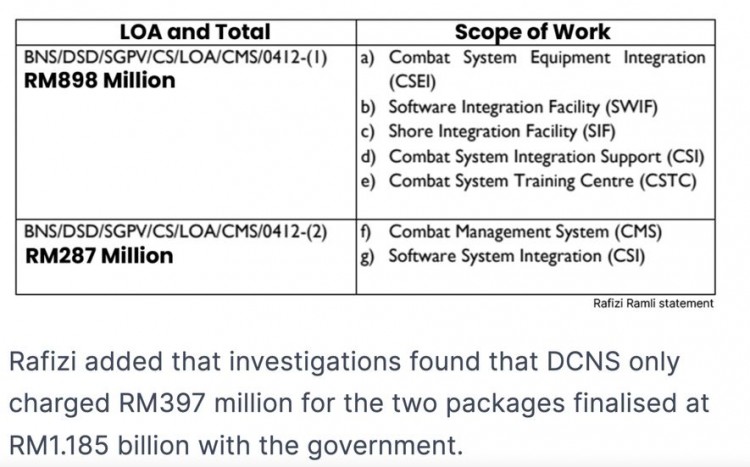

Opposition PKR’s deputy leader Rafizi Ramli has extrapolated from the report just how this layering was shown to have worked in creaming off enormous profits from the procurement commissions that went through Contraves.

In one instance a combined purchase order totalling RM1.185 billion from DCNS ended up being inflated 200%, thanks to the differences in price charged by DCNS to CED compared to what CAD charged Boustead’s BNS!

As the auditors point out, there was no actual practical justification for the middleman involvement in this case or in any of the other procurements for Boustead, which ought to have just gone straight to France’s DCNS, already chosen (controversially) to supply the materials for this deal.

This in itself extracted RM788 million which disappeared into the two intermediate companies whose accounts were being managed by Rheinmetall staff under Gordon Hargreave – as yet, no-one has explained where that money went.

Rheinmetall certainly offered no such information in its answers to Der Speigal, contenting itself merely with fuming about the fault not being theirs and the structure of the company being a normal arrangement.

As the auditors point out however, under this ‘customary arrangement’, which had been unaccountably agreed by the Board and management of Boustead, even the most enormous sums could be signed off for expenditure by Contraves with just the signatures of Hargreave himself and that of one over-powerful junior procurement officer at CAD whom the auditors describe as having none of the training required to be signing off hundreds of millions of ringgit worth of defence spending.

Time and again this one officer authorised ‘Letters of Variation’ (i.e. price adjustments on contracts which always inflated rather than coming down); apparent duplicate purchases and expenditures of often huge sums of cash for items already accounted for in previous buys; and also large unaccounted for ‘milestone’ fees to various providers…. who hadn’t actually provided the services they were supposed to.

This was how how chunk upon chunk of money was seemingly recklessly, negligently or deliberately (take your pick) wasted without the board calling matters to account for year upon year.

If the boss of Rheinmetall describes such an arrangement to be normal one wonders how this German company would have tolerated such floppy practices back home in a country renowned for its rigid reputation for orderly management ?

In Malaysia, of course, the sloppy pattern is only too familiar. As is the blatant reason behind the chaos and lack of supervision that was identified by the auditors, namely the decision made at the very top of the country’s decision making process to put this enormous state contract in the hands of ultimately just one man, Najib’s known catspaw Lodin Wok Kamaruddin, who had appointed everyone on the board of BHIC [Boustead Heavy Industries] rendering them lacking in independence and supine.

Board meetings and supervision soon fell away to all intents and purposes say the auditors (as was the case with 1MDB) to be replaced by a ‘circulated’ decision making reached through correspondence where the various board members were not equipped with sufficient information to evaluate the facts. They just signed in agreement as requested.

Protests from time to time were haughtily over-ridden by the junior procurement officer who was supported by the Loden Wok Kamaruddin appointed head of BNS, Ahmad Ramli Mohd Nor, (presently arrested and charged for allegedly having taken RM21 million in payment for his role in this affair).

Financially, Hargreave and this procurement officer, neither of whom worked for BHIC, were given the power to sign off whatever they wanted from the CAD/CED bank accounts with no further supervision needed from other members of the Board or managers.

It was “an arrangement that logically did not need the signatures of any persons representing the interests of BHIC ” who had “virtually no control over banking affairs” the auditors said. If that looks to be a glaring recipe for disaster then disaster was what happened.

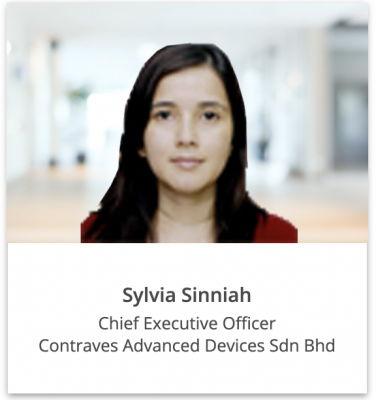

Rheinmetall has yet to detail how it was that it ‘lost money’ from this situation, let alone to explain why it has taken the company so long to complain about it. Hargreave himself moved out of the hot seat of the Contraves subsidiary in 2015 (coincidentally as matters became controversial in KL) and handed the post over to a young lady whom the auditors identified as his former secretary.

That lady was arrested earlier this year and then released having failed to provide adequate figures and evidence to a public accounts committee enquiry into the entire affair.

Meanwhile, the auditors have instead noted that as one of the suppliers to the project as well as the 49% shareholder CAD/CED, Rheinmetall was making a very healthy profit from the situation – one which the auditors considered to be unwarranted.

In one example of a major purchase of a product provided by Rheinmetall itself, the auditors point out that BNS could have bought it all directly, yet went through CAD/CED.

Instead of dealing with CAD the management could have directly issued an LOA to RAD (Rheinmetall) at a lower price as CAD charged a mark up over the contract price negotiated between the technical team of BNS and respective OEMs (original equipment manufacturers). This allowed RAD to make double profit, one as a supplier and other as share profit from CAD as a 49% JV partner. We could not find any valid reason to justify such a decision that proved detrimental to BNS and the LCS programme. This resulted in direct cost escalation, ultimate loss of profit and cash flow crunch. The Audit Committee of BHIC also raised their concerns on potential reduction in gross margins from the LCS programme due to higher cost of procurement through CAD/ CED and OEMS.

Under such circumstances it is not timely for Malaysia to demand that the CEO of Rheinmetall produce the figures that have been withheld by his company’s subsidiary from the BHIC and explain how it is that he regards the defence manufacturer as the victim in this affair to whom Malaysia owes some money?

Is it not also time that Mr Hargreave as opposed to his erstwhile secretary was instructed to show his face by his employers back in Germany and answer the slew of questions that the auditors and political figures have drawn up for him to find out where that missing billion went?

Sarawak Report suspects that the threats of court action in this matter may fade as the prospect of such a cross examination begins to loom, given that for years the players have rather chosen silence. We can only wait and see.

Meanwhile, Rheinmetall is not the only European player to have enmeshed themselves in Malaysia’s dodgiest ever defence deal of course.

The same auditors refer just as starkly to the “Suspicious Role of DCNS in the LCS Programme” in the later part of their report which is peppered by further damning references to such matters as the “unethical means adopted by DCNS”.

This is of course a French defence conglomerate that Malaysians know of only too well owing to its earlier culpability in Najib’s earlier grand submarine commissions – the so-called Scopene affair where senior DCNS figures were found guilty of bribing Najib and companies managed by his co-conspirators (including Lodin Wok Kamaruddin) to the tune of well over €100 million.

French journalists are now also scouring the equally jaw dropping information against this French company in the report and Sarawak Report will keep its local readers updated on the fall out there as well.