A case comes to trial in Switzerland, June 19th, that holds extraordinary implications for the reputation of the UAE.

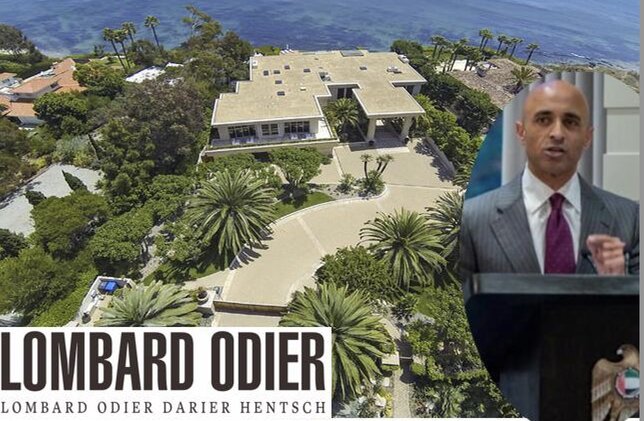

The Emirate’s current Ambassador to Washington, Sheikh Yousef Otaiba, long cited as a business partner of Jho Low and suspected recipient of kickbacks from the 1MDB fraudster, is identified in court papers for the trial of an officer of Lombard Odier bank as receiving $30 million from an offshore Jho Low entity, Pacific Harbor Global Growth Fund.

Otaiba’s business partner and main contact with Jho Low, Shaher Awartani, received $20 million as part of the same bogus deal (in true Jho Low style the bankers complained the fake documentation provided was shambolic).

Both the Emirati businessmen had opened their accounts simultaneously at the bank, just before the money came in in 2013.

This was shortly after Najib had raised 1MDB’s $3bn Goldman Sachs bond issue, as part of an alleged strategic partnership with Abu Dhabi’s Aabar sovereign wealth fund, which was the source of the money.

Otaiba was cited by Tim Leissner in court testimony as one of the players identified by Jho Low as being due for a kickback for his high level facilitation in the bond deal and two earlier bonds raised in the same way – the total money raised 2012-13 was $6.5 billion.

The case is against the compliance team at the bank (although the implication is that the complicity went to the top). Documents show that the officers who scrutinised the deal immediately identified the classic Red Flags associated with all of Jho Low’s flamboyant schemes involving Political Exposed Persons (PEPs), of which Otaiba was clearly one.

The obvious problem that caught their eye was the inadequate and amateurish documentation provided to explain the enormous payouts for alleged services performed for Pacific Habor. The money was frozen for some weeks as the team from Lombard Odier attempted to verify the massive transfers.

One item of information they obtained from probing their clients was that the money originated from contracts performed for 1MDB. However, when the bank asked to be put in touch with named officials from the 1MDB website to receive reassurance on the matter this was refused.

Another unsatisfactory aspect to the paperwork was the lack of identification for the beneficial ownership of the off-shore Pacific Habor company, now confirmed as having been owned by Jho himself. A scruffy signature at the bottom of the invoice provided to the bank had no name attached.

Don’t take warnings from ‘politically biased’ Sarawak Report!

Lombar Odier’s ‘due diligence’ process on the deal involved scouring the web for information about 1MDB and its bond issues. It did so in August 2013 and officers communicated with one another about a troubling article posted by none other than Sarawak Report just the month before.

This was the first of the many scoops on 1MDB published by this site, based on a leaked copy of the original ‘Magnolia’ bond offer document produced by Goldman Sachs, May/June 2012.

Having viewed the extraordinary level of commissions and interest obtained by Goldman Sachs (a characteristic of the crooked deals) Sarawak Report called foul, urging US regulators to investigate America’s most influential bank.

In emails to one another the Swiss bankers nervously quoted the threatening lines from SR’s concluding paragraphs in the article, which contained a direct warning to professionals like themselves contemplating further engagement with 1MDB.

These were the paragraphs they circulated to one another as they mulled over what to do:

“Under its Foreign Corrupt Practices Act the United States has prosecuted a number of corporations and banks who have failed to perform proper due diligence or have facilitated corrupt acts.

In Switzerland the authorities are already investigating the activities on UBS under parallel laws. And the German authorities have already looked once at Deutsche Bank’s involvement with Kenanga Holdings, the investment company which is co-owned by the Taib family’s CMS.

We suggest these authorities start checking through this series of Labuan deals, which have put such a huge and mysterious debt burden on the Malaysian people. The taxpayer has a right to transparency. [Sarawak Report July 2013]

The bankers had got the message about the risk and threat involved, reenforced by the warnings from this website. Nonetheless, according to court documents, they chose to weigh up those risks against the benefits of continuing to deal with the rich crooks from 1MDB and their Abu Dhabi partners.

Sarawak Report, they reassured each other, was “politically biased” and “lacked credibility”.

On what such conclusions were based is not made clear. However, rigorous fact checking is supposed to be the job of compliance departments and in 2013 there was no evidence to substantiate such claims, beyond the accusations of biased parties whom Sarawak Report had already accurately exposed for corrupt practice, such as FBC Media and their client Taib Mahmud.

Having thus comforted themselves with dubious excuses, the Swiss bankers from Lombard Odier, like so many others from that country, ignored the evidence provided by Sarawak Report and pressed ahead with the deal, thereby sealing their own eventual fate as one senior officer has now ended up in the dock charged with assisting money laundering by the bank thanks to greed and negligence.

The Swiss financial investigative website Gotham City, which broke this story, quotes that person behind the decision to press ahead, who emailed:

“Conclusion: unless we lower our compliance requirement, we will probably return the recently arrived USD 50 million and lose the rest of the relationship (USD 70 million). We also risk collateral damage in Abu Dhabi where our customers are well introduced. If it were up to me, I would be willing to take the compliance risk to keep the client (whom I met personally) and avoid collateral risk in this strategic market”.

Money in the highest places

Meanwhile, the teflon qualities of the Gulf high rollers in this affair have kept them largely cushioned from the impact of this scandal, until now.

Sheikh Otaiba’s role has been documented. There has been speculation that his expensive toy, a $50m Malibu mansion (see above) purchased in the wake of this mammoth payment, is indeed another trophy from the multi-billion dollar heist from the people of Malaysia.

Yet, cocooned by diplomatic immunity and surrounded by the status offered as the Ambassador to Washington of the oil rich Gulf monarchy, Otaiba has simply swum above the fray.

Abu Dhabi is yet to do anything about the embarrassing situation, which they have ignored in the same manner as they have ignored the purchase of Sheikh Mansour’s super yacht with the same source of cash.

The funds by which Sheikh Mansour, through the 1MDB ‘guarantor’ fund Aabar, purchased his other most famous toy, namely Manchester City and its many top players, remains a matter of contention.

Certainly, the destination of much of Malaysia’s missing 1MDB money is still unclear.