More than nine years after Sarawak Report first reported details of the initial $1.83bn theft from Malaysia’s 1MDB fund through a bogus joint venture with their sham group of oil companies, the two key collaborators behind PetroSaudi International have finally been brought to trial.

They stand accused by Swiss prosecutors of having enriched themselves by almost a billion dollars from criminal proceeds of that theft with the director and and present only shareholder, Tarek Obaid, personally approaching billionaire status.

Obaid gained $580 million as a direct result of the thefts and at least a further $225 million indirectly through the enrichment of the PetroSaudi group – before the heist he could boast only a few thousand francs in his bank accounts.

The Saudi national, who is based in Switzerland, is due to appear together with PetroSaudi’s British Chief Investment Manager, Patrick Mahony, in the Swiss Federal Court in Bellinzona from Tuesday, April 2nd.

Obaid and Mahony were first exposed by Sarawak Report and the Edge in Malaysia

The duo face a slew of charges in an indictment that runs to several hundred pages, including allegations of serious fraud, aggravated money laundering and multiple acts of obstruction.

Another major beneficiary of the alleged thefts, the Saudi Prince Turki bin Abdullah, who was previously a 50% shareholder of the group, has been imprisoned on separate charges in Saudi Arabia since 2017 with his whereabouts unknown.

The indictment details how some $77 million was channelled to Prince Turki from proceeds of the theft.

Patrick Mahony, the financier who orchestrated the web of money laundering operations signatures by Obaid, received a relatively modest $37 million for his criminal services.

Their Malaysian co-conspirator, Jho Low, who acted as the now jailed ex-PM Najib Razak’s secret proxy controlling 1MDB, himself profited by, “at the very least”, $800 million from the PetroSaudi linked transactions the indictment notes.

This, bearing in mind that Jho Low was to extract further massive amounts from the later crooked bond issues totalling $6.5 billion involving Goldman Sachs plus from the $1.2 billion raised in loans from Deutsche Bank.

Thus, even a decade after the scale of the operation came to be known as the world’s largest recorded theft, the latest allegations have the power to shock.

The Swiss prosecutors may have taken their time as their belated targets lived a life of luxury, debauchery and excess, and fought back against investigators with armies of expensive litigators.

However, they have made up for the delay with the forensic precision of the detail in this indictment boasting over a thousand references, to show exactly how the stolen money travelled into the conspirator’s various bank accounts, together with the lies and conflicting excuses used to cover up the criminal origins, money laundering devices and fraudulent expenditures.

On one occasion, Tarek Obaid explained to his bankers that the company Good Star Limited, which received $700 million siphoned out of the original billion dollars paid by 1MDB into the bogus 1MDB/PetroSaudi ‘joint venture’, was owned by none other than the King of Saudi Arabia.

In fact, as 1MDB watchers will be well aware, the sole shareholder of the Seychelles company was Jho Low himself, who had paid Tarek Obaid $85 million in commission for acting as a front in the fraudulent joint venture (of which Obaid paid $33 million to Patrick Mahony).

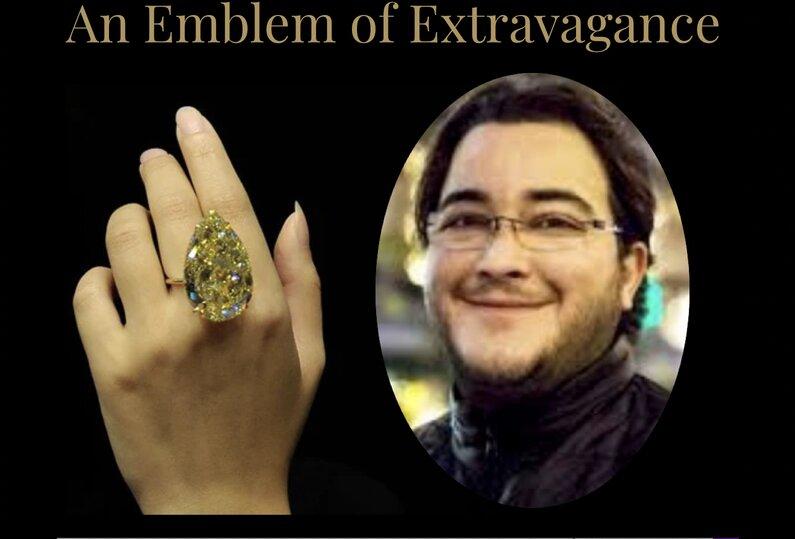

Notable purchases by Obaid included a record breaking CHF 11,282,000 ($10.9m) for the so-called ‘Cora Sun-Drop” yellow diamond bought at auction from Sotheby’s in Geneva in November 2011. Also, a Philippe Patek “Sky Moon Tourbillon” watch bought for CHF 1,078,055 (a million dollars) in the UAE.

Yacht parties were a theme for Tarek Obaid

The hedonistic fraudster twice rented the yacht Tatoosh for holidays in 2011 and 2012 for a cost of over $3 million. His debauched parties onboard such floating palaces became the stuff of gossip columns around the Mediterranean.

Of course, it was on an earlier occasion aboard a hired yacht, the Alfa Nero, that the original conspiracy between Najib, Jho Low, Obaid and Prince Turki was hatched in the presence of Najib’s wife Rosmah Mansor.

Malaysian PM’s yacht meeting with Prince Turki and Tarek Obaid one month before the 1MDB/PetroSaudi ‘Joint Venture’

Sarawak Report has learned that amongst those attending the trial will be the key whistleblower in this affair, Xavier Justo. The former colleague and director of PetroSaudi was subjected to aggressive retaliation after he released documents from the company database which revealed the fraud.

PetroSaudi denounced him on false charges and orchestrated his imprisonment for 18 months in a Bangkok jail, whilst they coerced and blackmailed him and his wife Laura into condoning a false narrative in an attempt to undermine the reports by Sarawak Report and Malaysia’s The Edge newspaper based on his evidence.

However, the Swiss prosecutors conclude in this indictment that none of the PetroSaudi claims were true, as did investigators for the US Department of Justice in earlier investigations.

Misinformation was produced by Obaid and Mahony, defaming both the Justos and Sarawak Report in order to dissuade banks from reporting concerns to the regulators.

For example, the indictment details how on 29 April 2015, Tarek Obaid gave JP Morgan bank in Geneva a so-called “Technical Intelligence Report” report by a British investigations company called Neon Century.

The report claimed to show that Xavier Justo had stolen data in order to blackmail PetroSaudi, and that the documents published by Sarawak Report had been falsified. As one banker cited in the indictment described to colleagues:

“[NEON CENTURY] have concluded a 90 page report that shows that former PS employee Xavier Justo stole PS electronic files and documents. The coding shows that he altered emails and other documents (including White & Case presentations) to blackmail PS and TO for money. Xavier was paid $3MM when he departed PS in 2011 and he called in 2013 ask ing for more money. TO refused. Neon Century was also able to access the Sarawak blog and see that they received and used altered documents that were stolen from PS. TO will send the 90 page report to JPMS but stressed that this is confidential. He again stated that all of this started when the Malay opposition leader lost the election to the current PM and the opposition is looking for “dirt” to tarnish the PM”.

The indictment says that on the basis of this Neon Century report (a firm that advertises itself as providing ‘intelligence with integrity“) JP Morgan concluded that the information reported in Sarawak Report, “had to be put into perspective”. As a result, the bank did not notify MROS.

In fact, the indictment confirms “the data published in the press and reviewed by NEON CENTURY in its report, corresponds to the original version found on the company’s server”. In short, Sarawak Report published accurate data which was misrepresented in the purported Neon Century report, even though it was reviewed by Neon Century.

The CEO of Neon Century is an ex cyber-expert employed for over a decade by the UK Government intelligence service GCHQ.

A former deputy director of GCHQ working for another security outfit, Protection Group International, named Brian Lord, was also hired by PetroSaudi for a similar purpose. A report by PGI was presented by Brian Lord to the Bangkok media in July 2015 likewise claiming that Sarawak Report had ‘doctored’ Justo’s ‘stolen material‘ from the PetroSaudi database.

The Swiss indictment likewise confirms every detail of the 1MDB/PetroSaudi joint venture heist as reported since 2015 by Sarawak Report, adding damning information provided by the banks who processed the money, including RBH Coutts, JP Morgan and BSI who claim they were lied to by the three main conspirators.

All three banks have faced censure for failing to issue appropriate money laundering reports.

Likewise, the former PetroSaudi COO, Rick Haythornthwaite, who was controversially appointed as the new Chairman of the major NatWest Bank in the UK this year, is also cited as having been fooled. He has given evidence against Obaid and Mahony as a prosecution witness, saying he had no knowledge of the criminal conspiracy and bogus valuations that inflated the value of PetroSaudi’s assets to support the fraudulent joint venture.

Who will show in court?

Those attending court over the coming days will be waiting on the appearances of the two alleged master criminals. Their accomplice Jho Low turned into a fugitive from western law enforcers as early as 2015.

For the past decade Obaid and Mahony have been left free to travel, conduct their business and lead luxury lives. Obaid has increasingly stayed within Switzerland (following a short incarceration in China related to questions over 1MDB) whereas Mahony has travelled widely.

Will the pair finally appear in court to plead their claim of innocence or, as some have speculated, might they have taken advantage of Swiss white collar leniency to follow the example of Jho Low?

One certain presence at this trial will be the representation from the defrauded Malaysian fund IMDB and its successor Brazen Sky Limited, set up as the custodian of Malaysia’s alleged ‘profits’ from the joint venture (which consisted of ‘promissory notes’ from the worthless PetroSaudi subsidiary that had allegedly invested the cash from the joint venture).

These have been admitted as complainants as the alleged victims in the case. The two entities have lodged civil submissions against PetroSaudi for more than $5 billion in damages.

Xavier Justo, on the other hand, was denied a claim over his treatment and false imprisonment in this case and was never granted whistleblower status by Malaysia.

Likewise, Sarawak Report which has been rewarded for its assistance in exposing the scandal and repatriating billions to Malaysia with a criminal prosecution and two year sentence passed in February for purported defamation of a public figure.

Further details on the charges and PetroSaudi trial tomorrow