Crucial to Jho Low’s life as a wheeler dealer financier has been his team of trusted insiders.

Together, this band of close associates have circled the globe, enjoying a life of luxury and excess unimaginable to the bulk of ordinary Malaysians.

Yet, it is those ordinary folk who are effectively funding it all, thanks to 1MDB’s investment decisions, master-minded to a large extent, as it has now emerged, by Jho Low himself.

So, who were Jho Low’s special contacts and who helped him weave his magic?

Rosmah Mansor

Insiders say that Jho Low’s key initial Malaysian contact was the PM’s stepson Riza Aziz, whom he met while at school over in the UK.

Jho Low then spent plenty of time ingratiating himself with Riza’s Mum, Rosmah Mansor, whom he generally refers to as ‘Madame’ or ‘First Lady’.

By the time Najib Razak was Deputy Prime Minister, Jho Low was already well in with the family and full of helpful information for Rosmah and her husband about how to ‘fix things’ financially.

The PM has openly acknowledged that Jho Low offered crucial advice on how to turn the so-called Terengganu Sovereign Wealth Fund into One Malaysia Development Berhad (1MDB) and re-launch it as a development fund for Malaysia.

Rosmah’s high living has already created dangerous levels of comment and concern around Najib Razak’s premiership, simply because there has been no credible explanation forthcoming for it.

In the past few days Najib’s own brothers have issued a formal statement to the media, deploring any suggestion that this money might have come as “inherited wealth” from the Razak family.

However, this was the explanation that had been provided to the New York Times when the newspaper recently questioned the Prime Minister’s office.

The rest of the Razak family have now formally demanded that any such suggestion that their father, a former prime minister himself, might have corruptly acquired and passed down such sums of money be withdrawn.

It has left Najib isolated, even from his own family.

Riza Aziz

When Rosmah ran up a fantastic quarter of a million dollars bill at the bespoke luxury Bel-Air hotel in Beverly Hills, Red Granite insiders told Sarawak Report that the tab was picked up by the Hollywood production company.

In turn, the owner of Red Granite, Rosmah’s son and Najib’s step-son, Riza Aziz, was being financed, by all accounts, by Jho Low.

A recent article by the New York Times has confirmed that Riza’s luxury house in Beverly Hills and his multi-million dollar apartment in New York were bought by Low.

The duo have become well known the fixed members of a party circuit that has included jaunts at Caesar’s Palace in Las Vegas, yacht parties in the Mediterranean and luxury trips to watch Formula 1 and the World Cup in Brazil.

One famous Hollywood personality has said he was offered half a million dollars to accompany the revellers to Las Vegas, with private jet, hospitality and gambling chips all thrown in by Jho Low.

He declined, but it is believed that others (people of considerable international fame) have accepted.

Riza has subsequently denied that it was Jho Low who provided the finance for his movies, including the $100million dollar bill for the Scorcese hit The Wolf of Wall Street.

However, as the New York Times has confirmed, many in the Hollywood community were led to understand by Red Granite at the time that Jho Low was indeed the funder of the film – he received a special credit of thanks at the end of the movie.

Li Lin Seet

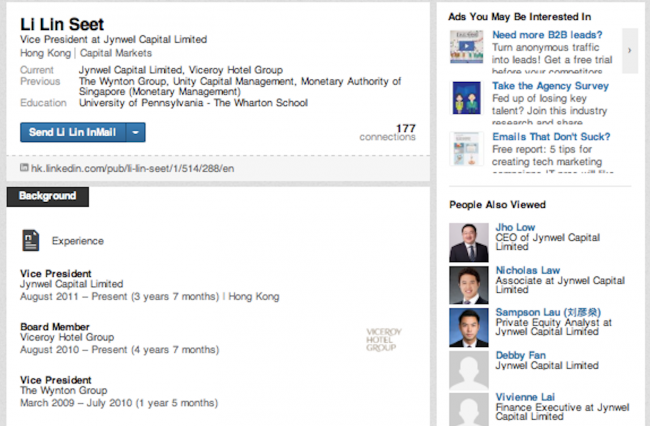

Seet was a contemporary of Jho Low at Wharton Business School in Pennsylvania.

As his LinkedIn entry makes clear, Seet worked for Low’s first enterprise Wynton Capital and has hardly strayed from his side since.

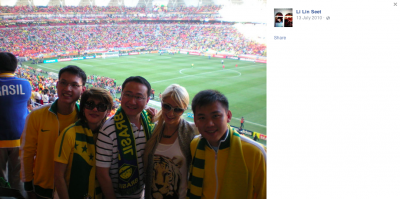

Seet has also been part of the inner circle playing around town with Riza, Jho Low and the cool gang of billionaires with unlimited income – average age around 30.

It was when Seet was still based at Wynton Capital that he sent and received numerous emails regarding the 1MDB PetroSaudi Joint Venture from this address.

He now describes himself as a Vice President of Jho Low’s current company Jynwel Capital, based in Hong Kong.

Seet was copied into the correspondence respecting the JV deal between PetroSaudi and 1MDB in September 2009.

That correspondence minutely reveals Jho Low’s driving involvement in every aspect of the deal.

It was also Seet who joined Jho Low and a fellow Wynton employee, lawyer Tiffany Heah (she also worked for UBG Bank) at their initial crucial meeting with PetroSaudi’s Patrick Mahony in New York, at which Mahony agreed that the firm could “act as a front” for their business activities.

And it was Seet who performed the role as the signatory for the firm Good Star, into which the USD$700,000,000.00 “loan” cum “premium” was paid on the conclusion of that joint venture deal.

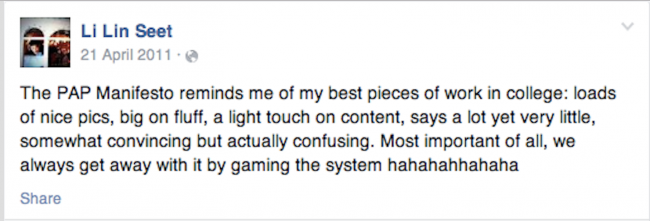

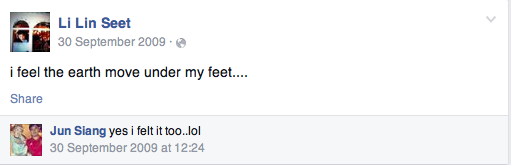

On the day that the money finally transferred into the Good Star RBS Coutts Zurich account, Sept 30th, Seet went on Facebook:

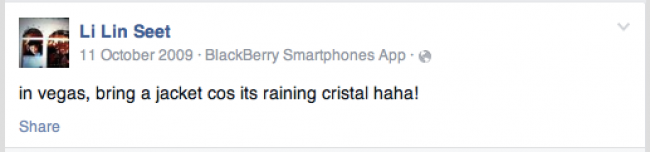

A week later Li Lin Seet was embarking on the party lifestyle that became the hallmark of Jho Low and his crowd of business hangers on over the coming years – a lifestyle that was so expensive and extravagant that it attracted attention across the world.

Cristal is the most expensive champagne you can buy – this is what See messaged from Las Vegas:

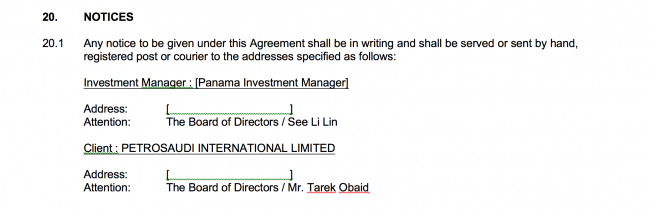

Li Lin Seet was also the signatory of the company Panama Investment Manager, which did a deal with PetroSaudi ‘front man’ Tarek Obaid to manage the funds of the PetroSaudi ‘subsidiary’ in the Seychelles.

That was the company which acted as the parent company of Javace Sdn Bhd and which later bought out the Taib family’s UBG bank.

Behind the scenes, we have established that PSI Seychelles had done a deal surrendering all of its USD$610million, which were the proceeds of the $700million “loan repayment” from 1MDB, putting the whole sum under the total direction and control of Panama Investment Management.

Armed with this decision making control, the Jho Low controlled Panama Investment Manager bought over UBG bank in the name of Tarek Obaid and PetroSaudi International:

Delightfully for the young men involved, there was clearly plenty of money left over in the system to fund a very expensive life-style for Seet and some new found friends on the celebrity circuit.

But, it was a bad lesson.

Again on Facebook, Li Lin Seet gave an insight into the way he has learnt to do business: