Sarawak’s business community have been somewhat mystified by the announcement of a new ‘White Knight’ to bail out the Taib family controlled Sarawak Cable formed to secure the lucrative contract to manufacture cables from the Bakun dam to the local grid and Kalimantan over in Indonesia.

Apparently the offspring of the so-called CEO of Sarawak, former chief minister Abdul Taib Mahmud, have failed to manage this monopoly as successfully as one might have hoped.

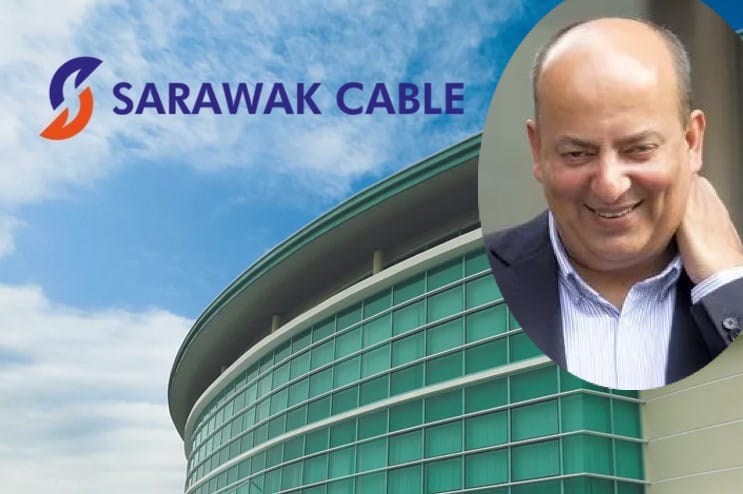

However, the name of the RM250m takeover bidder, announced by The Edge last week, rang no bells in the industry. Perhaps this is no surprise since Serendib Capital Ltd, which the paper described as undertaking a “resuscitation exercise to revive the loss-making manufacturer” is described as based in the UK.

However, a swift review of Serendib Capital has so far provided more questions than answers about the rescue bid. Company enquiries reveal the company was incorporated just last September, by just one man for just one hundred pounds (RM600).

It has to be said, the man in question is a banker of some renown and is clearly in the business of being able to mobilise considerable capital should this be the immediate fix the company in Sarawak is needy of.

He is one Rafat Ali Rizvi who clearly has a history of high rolling deals, although not all of them have gone as smoothly as he might have liked.

Most notably, he and his partners fell out big time with the authorities over the border in Indonesia in 2008 following the bailout of Bank Century (now bank Mutiara) during the global financial crisis.

That country executed an INTERPOL Red Notice for the British national’s arrest and extradition having laid criminal charges against him and alleged co-conspirators.

According to a summary of the case by the UN drugs and crime agency UNODC, the defendants “were alleged to have illegally caused the collapse in order to enrich themselves and certain third persons“.

Thankfully for Mr Rafat Ali Rizvi, following the high profile intervention of a hard hitting law firm Gherson LLP these charges were found to have been politically motivated and unjust.

In a rare move INTERPOL was prevailed upon not only to reject the Red Notice against Mr Ali Rizvi but to publish its own notice exonerating him and a banking colleague.

Clearly this incident has not frightened the banker away from taking up further business in South East Asia and doing so in a personal capacity. This is a sizeable commitment for a one man company which has so far not recorded any further injection of assets that would explain the massive investment promised in its name.

However, Sarawak Report is not privy to all the intricacies of high finance and has not so far traced this global financier to ask further questions.

Doubtless he and his Taib family partners in Sarawak have a plan to mobilise investors and the necessary expertise to re-invigorate the company in its sector and have explained all to the relevant regulatory bodies.

Doubtless they soon will also do so to interested Sarawakians. However, the folly and arrogance of a family who attempted so long to run the state as a quasi family business has been exposed once again for the greedy sham it always was.

After all, more than a decade after the Bakun Dam became operational, native communities up and down the state and in the surrounding area remain unconnected to the grid. That was the purported reason for building this destructive white elephant of a mega-project that lined the pockets of the rich and powerful.

It was Sarawak Cable that was supposed to provide the transmission lines that have so far failed to fulfil that promise.